The thing is, I’ve spoken to a lot of different companies and firms over the last year or so, and none of them would apply that term to themselves – and rightly so. The general feeling is “We’re doing things as well as we possibly can; the problem’s with certain other providers out there talking nonsense to our clients”.

Hmm. Interesting. So on one hand, almost everyone I speak to feels their business has been negatively affected by cowboys, but on the other hand – I can’t find many. So what’s going on here? Is the market awash with cowboys or not?

Here’s what I think is happening.

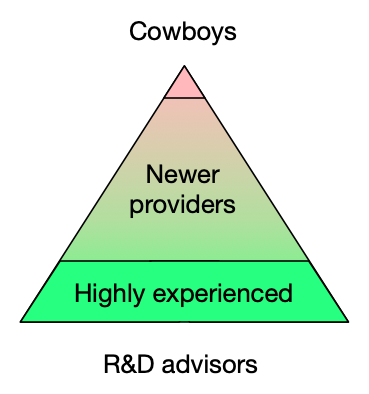

Let’s start by visualising the R&D advisor market as a blank pyramid.

We’re going to start by adding the cowboys, but before that, let’s define who we mean. I appreciate everyone’s going to have their own view on this, but in my opinion, an R&D cowboy is someone who routinely:

- Lies to companies to win their business

- Makes promises they can’t possibly keep (or don’t intend to honour)

- Ensnares clients in contracts they can’t escape from

- Falsifies claim expenditure or project narratives

- Submits documentation to HMRC without the client’s knowledge or sign-off

- Vanishes when HMRC opens an enquiry

- Prioritises their fees over everything else

In short, they are knowingly defrauding the R&D tax relief scheme and are creating serious liabilities for their clients, whether those companies realise it or not.

But how many advisors actually fit that profile? It’s difficult to say for sure, but my guess is that only a very small percentage are engaged in fraudulent behaviour. (After all, most people aren’t silly enough to play with fire, because they know it’s just matter of time before they get burned. And more fundamentally, most of us are decent human beings who find that behaviour abhorrent.)

So let’s represent the cowboys by adding a very small slice to our pyramid.

Our question then becomes – How can such a small group of people have such a disproportionately large impact on the market?

Clearly something else is going on.

Next, let’s go to the other end of the spectrum and add the highly experienced advisors. These people have many years of experience in helping clients, have learned how to defend and avoid HMRC enquiries, have a high degree of confidence in their knowledge and abilities, and generally give their clients accurate advice that balances the interests of the client with respect for the rules of the R&D scheme. For these people, doing the job well is usually more important than the fees they earn.

But…the knowledge of these highly experienced advisors isn’t easy to come by. It’s gathered slowly over many years and is usually based upon painful mistakes and lots of weird edge cases. So while these people are far more numerous than the cowboys, they’re probably not in the majority. Their expertise is simply too…well, expert, for them to be thick on the ground. So let’s add them to our diagram as a significantly sized group, but not the largest.

Ok, we’re getting closer to working out what’s going on. Our question now becomes – What’s filling the gap between the highly experienced experts and the cowboys?

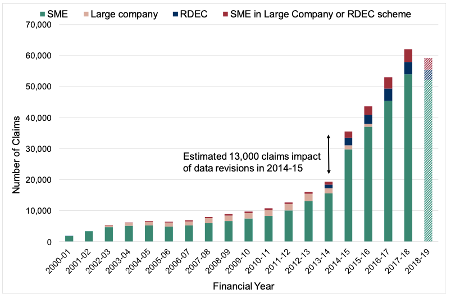

Well, this one’s easy to answer. If you look at any graph showing growth in the R&D tax relief scheme, you’ll see something like this:

The R&D scheme’s grown like crazy, driven by new providers rushing into the market to help clients themselves, rather than outsourcing work to specialists. They’ve come from all walks of life – business coaches and consultants, PPI pushers, technologists, and accountants seeking to take on work they’ve formerly outsourced to specialists.

The draw of the R&D scheme has been so strong that this group of people probably now makes up the largest group of R&D advisors, bridging the gap between the seasoned experts and the cowboys.

I believe the vast majority of these newer providers are also decent, honest people who want to do the best job they possibly can for their clients. They want to do things right, and ethically – but here’s the real problem: HMRC’s definition of R&D for tax purposes is absurdly complex and subjective. This makes it difficult for all advisors, but especially the newer ones, to know with any confidence what’s eligible and what’s not.

To support this, just look at the definition of R&D for tax purposes (Google “CIRD81900” to find it): it’s completely open to interpretation. What constitutes an advance in science or technology is subjective; it depends on the views of a competent professional. Whether someone is deemed a competent professional is subjective. Whether something is a technological ‘uncertainty’ rather than a ‘unknown’ is subjective. Where R&D starts and ends is subjective. It’s shades of grey on grey.

This might explain why so many of us feel impacted by poor quality claims even although cowboys are actually fairly rare: the complexity and subjectivity of the R&D scheme itself has led to a multitude of claims being submitted by advisors who genuinely believe they’re doing the right thing, but whose claims aren’t, in fact, particularly compliant with the rules and guidance. (As they tend to discover during their first enquiry.)

My guess is that for 9 out of 10 anecdotes along the lines of ‘I can’t believe that company X got away with claiming for Y’, the claim in question has come not from a cowboy, but from a provider with limited experience but good intentions, who is interpreting the definition of R&D differently to HMRC or a seasoned expert.

I want to stress that I am not blaming anyone for getting it wrong; I’m saying that the guidance is so complex, nuanced and subjective that it’s extremely difficult to get it ‘right’. (And what does ‘right’ even mean in the context of such a subjective standard?)

To pause for a second and recap, I’m saying that:

- Cowboys are an issue, but possibly a smaller one than we think

- Lots of people have entered the R&D consultancy market with the best of intentions

- The complexity of the rules makes compliance extremely difficult to achieve

- Differing interpretations has led to great variability in the claims being filed

- Cowboys have been blamed for this perceived lack of compliance, when actually it might have more to do with the definition of R&D itself.

For a long time, people concerned about R&D tax credits have been saying ‘Something must be done!’. And to give HMRC credit, they are responding – their latest consultation shows that they’re at least thinking about how to do things better.

So, should we just sit back and wait for regulation, or for HMRC to completely reformulate the scheme? Well, sure, but that’s going to take a while, and I’m eager for change now.

I believe there is an opportunity for us, as compliance-minded R&D advisors of all stripes, to come together to:

- Voluntarily and collectively develop standards of Best Practice & Ethics for R&D that go beyond the Professional Conduct in Relation to Taxation (PCRT) guidance;

- Develop practical and detailed online training courses that standardise a shared understanding of how to interpret and apply HMRC’s guidance;

- Support each other in developing our skills and experience as R&D advisors;

- Lobby for positive change in the R&D tax relief scheme, with a focus more on making compliance easier and less subjective, so that there is more agreement, fairness and consistency about which clients and projects are eligible, and which are not.

This is exactly why I founded The R&D Community: to develop online training and support for any advisor who wants to improve their knowledge of, and confidence in, the R&D tax relief scheme. The experts don’t need much help (unless they’re scaling up), the cowboys don’t want it – but for everyone else…well, The R&D Community is designed for you.