But the larger your portfolio, the harder it can be to know where to start. You don’t have the time to talk to everyone at once, so you have to prioritise your efforts and work out a short-list of companies that might have qualifying work (and be receptive to you helping them to prepare their claim).

The question is – what’s the best way of using your scarce time to get your R&D service under way? In this article, we’re going to explain the 4 steps you can follow to do exactly that.

We’ve also create a spreadsheet template to allow you to quickly see which clients are worth following up with, based on your own priorities.

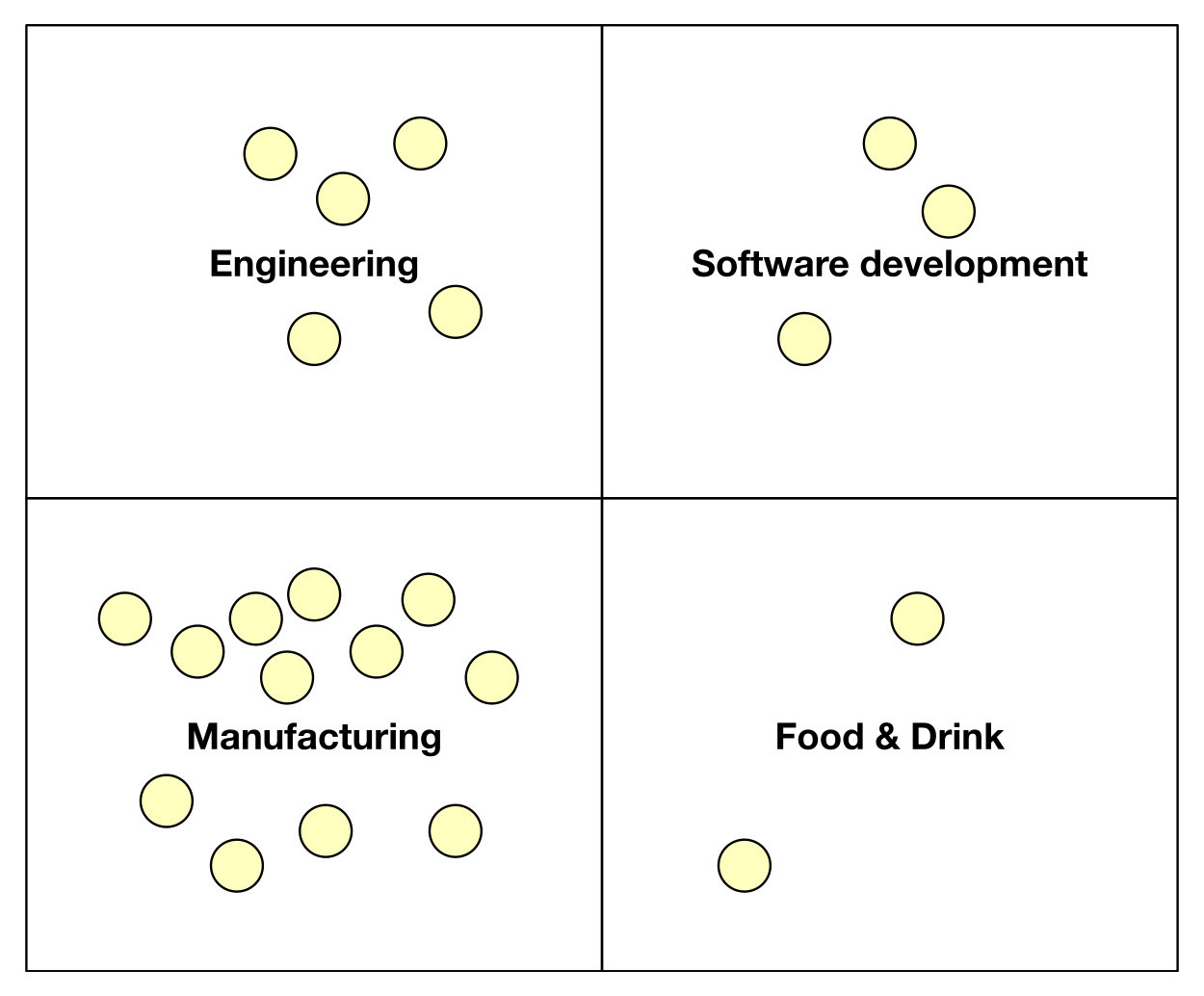

Step 1 – Sector grouping

A common trope used by R&D consultancies is that “any sector can be eligible for R&D tax relief”. While it’s true that any company can potentially meet the criteria, the reality is that certain sectors are richer in potential than others. You wouldn’t be looking at care homes or restaurants, for example.

In Step 1, go through your client base and allocate them to one of:

- Engineering

- Software development

- Manufacturing

- Food & Drink

Don’t do this on the basis of their SIC code (since they’re often inaccurate) but from their websites and what you know of their activity.

These four sectors represent the majority of claims, so while you might not catch every client in your portfolio, you’ll certainly get enough to start off with. If your firm has a bias towards any particular sector, that’s going to show up now.

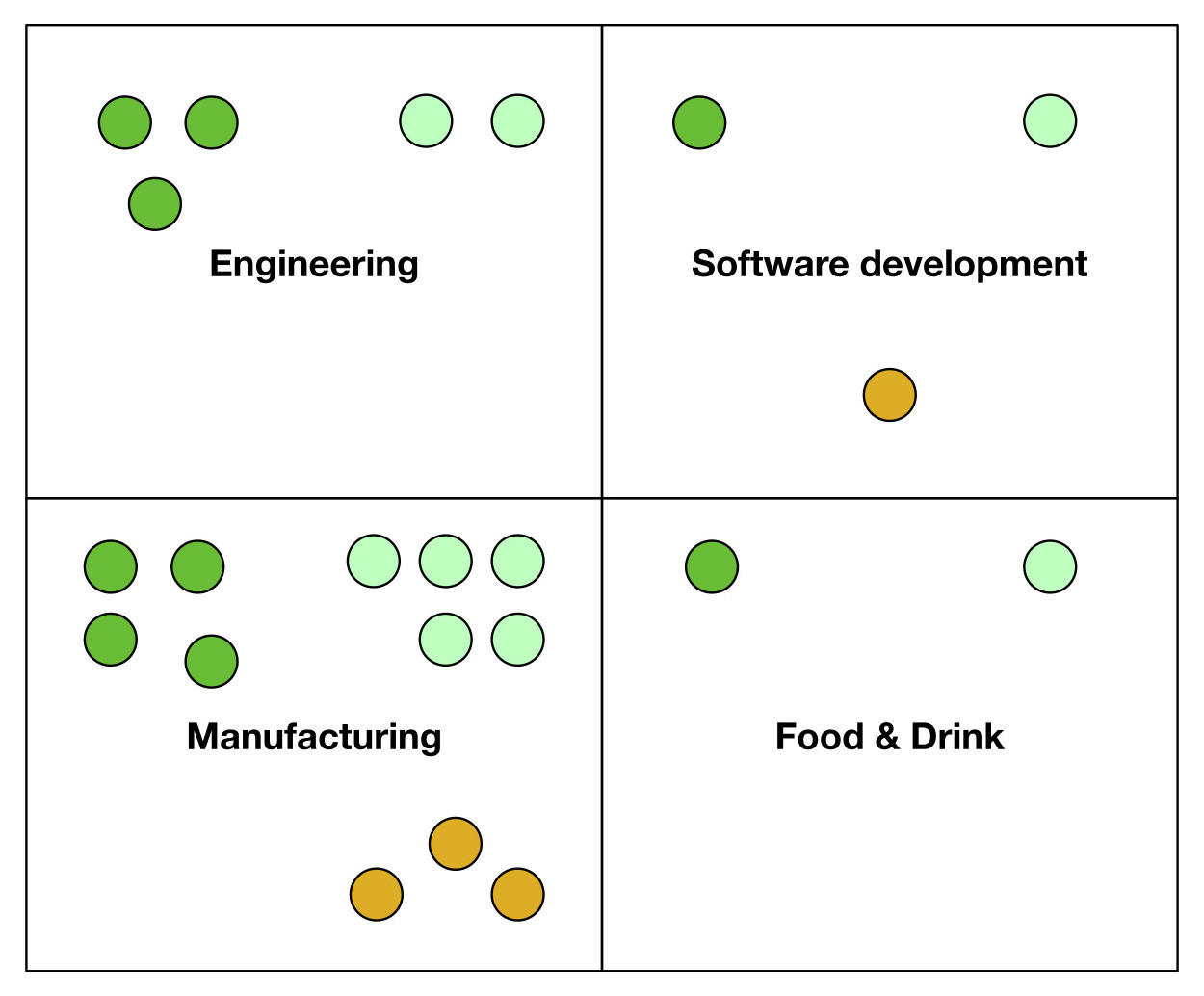

Step 2 – Sort by whether they’re already claiming

Next, for each sector, identify the clients that are already claiming for R&D tax relief. They’ll most likely be working with an R&D consultant, but some might be preparing the claims themselves. This will give you three categories per sector, namely:

- Claiming via an R&D consultancy (dark green)

- Not yet claiming (light green)

- Claiming themselves (orange)

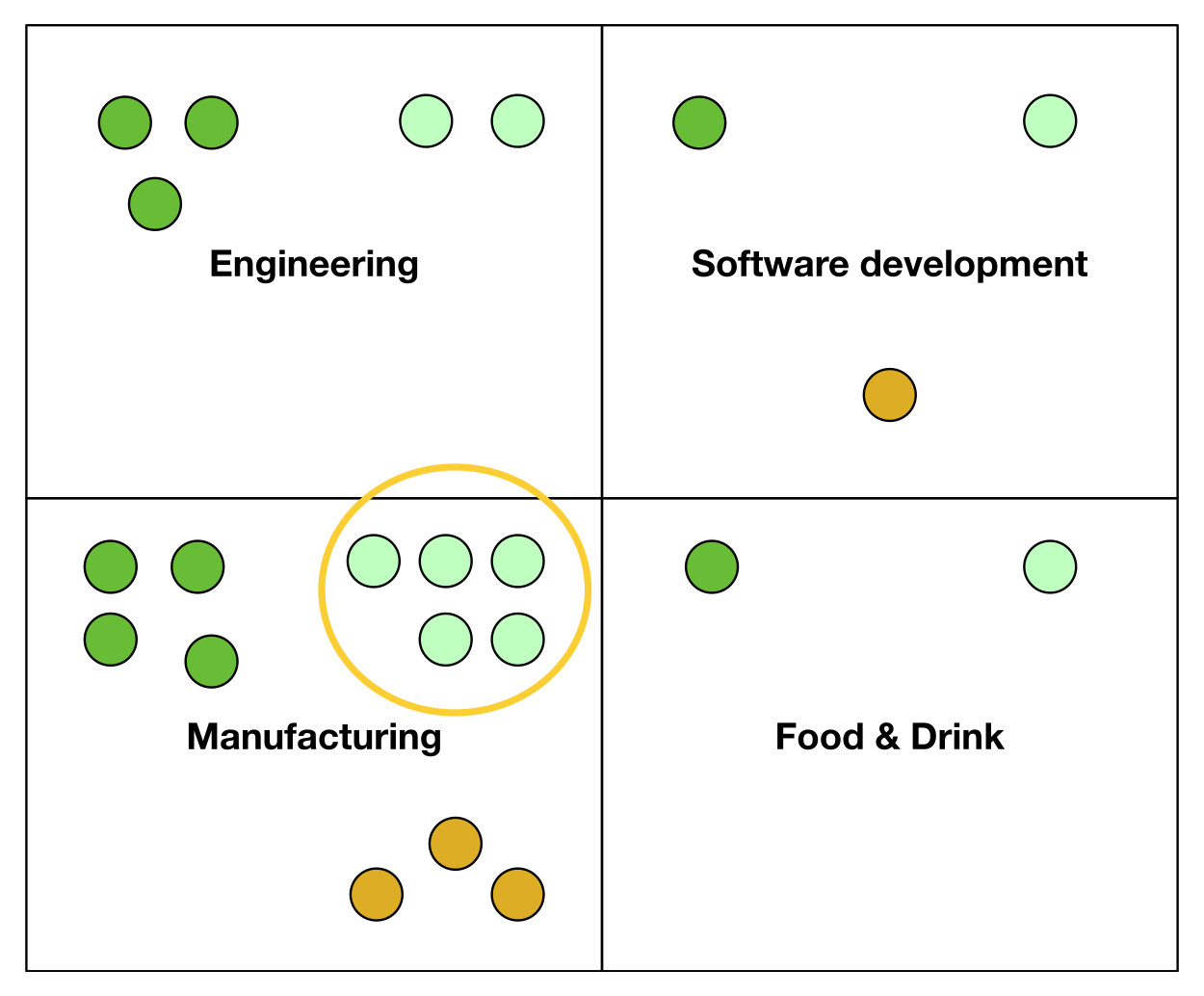

Step 3 – Prioritise

You’ve now done the hard part of classifying your corporate clients. Now comes the fun part of prioritising which client segment you’re going to approach first. This is likely to depend on:

- Whether you feel more comfortable with a particular sector

- Whether you want to focus on

- switching clients from R&D consultants

- companies with a much lower awareness of the R&D scheme

- companies with a relatively high level of confidence and comfort

In the example below, you’ve chosen to focus first on manufacturing clients that aren’t yet claiming. (If your portfolio is really big, you might also want to sort this sub-group by size too.)

Step 4 – Prepare your pitch

With your priority group established, you now want to prepare your pitch. Jot down some thoughts about what your offer is and how you’re going to position and sell it.

If your priority is clients that are already claiming via R&D consultants, your positioning might include talking about how HMRC is tightening standards on R&D and the increasing importance of compliance. Or you might simply offer to under-cut the consultant.

If your priority is the clients who aren’t yet claiming, you might want to offer them an educational session to discuss HMRC’s criteria and whether some of their work would qualify. You could combine this with a warning about what to expect if they’re contacted by R&D telesales teams promising the earth.

If your priority is the companies that are already preparing their own claims, think about how you could add value. That might be by performing an independent risk assessment of their claim, or by offering to take some of the legwork out of the preparation process using R&D claim software.

Next steps

Make sure you download your spreadsheet template to prepare your own portfolio review. You can identify your own priority groups, and then get a custom priority score for each client, to help you make efficient decisions about who to follow up with.

Download the Portfolio Review Template

With your priority group identified and your pitch prepared, you’re all set! You’re ready to go have some conversations with clients about whether or not an R&D claim is right for them.