Free training on R&D Tax Relief Claims

An Advisor’s Essential Guide to the Merged R&D Scheme

Our free course will help you to:

- Understand the new Merged R&D Scheme and when to claim under it

- Work confidently with complex areas of the new scheme

- Update your processes with the new rules and requirements.

Get up to speed on the new scheme, quickly.

With all of HMRC’s changes to R&D tax relief, you need to be:

- Confident that you and your team understand how the merged scheme works

- Confident that you’re advising clients based on fully up-to-date information

- Confident that your claims are prepared to the high standard that HMRC expects

- Confident that you’re complying with all the rules and regulations that apply when giving advice on R&D tax relief.

Ready to master the Merged R&D Scheme?

Our free course is not just stuff you can find online. It’s based on our collective experience of working in R&D for decades, and our detailed analysis of the legislation defining the new Merged R&D Scheme.

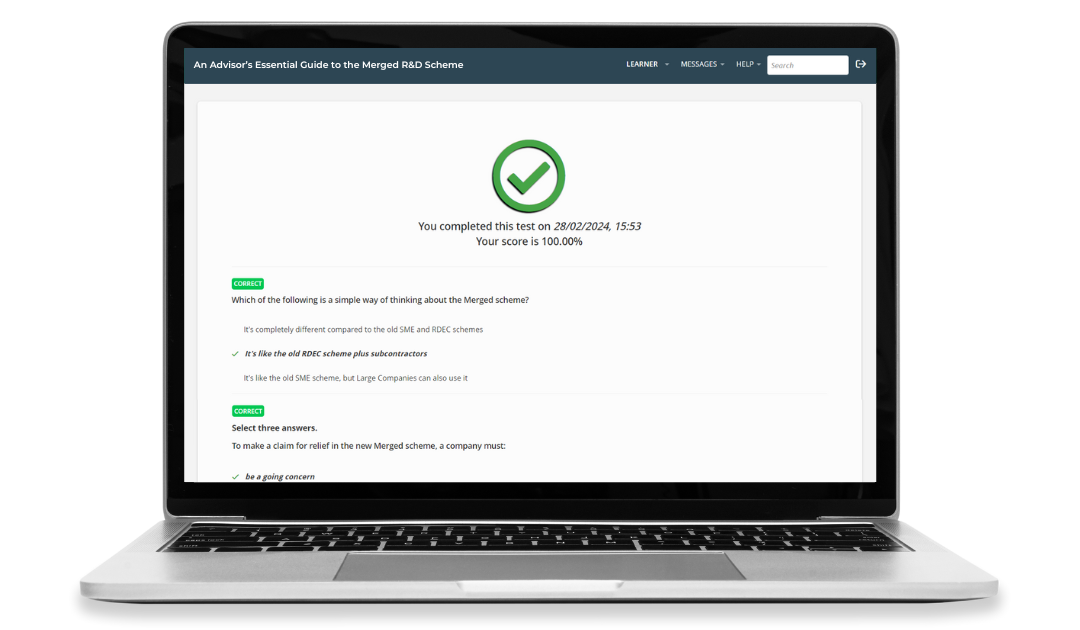

The course is broken down into 4 units, each containing bite-sized video lessons and short quizzes at every stage. It’ll take you around 60-90 minutes to complete.

Max Glennon

The course has been incredibly useful to help us quickly decipher some of the more nuanced changes in the Merged Scheme, particularly in relation to subcontracted costs (both domestically and overseas), as well as how grants and subsidies interact with the new scheme.

Oliver Mountford

I found the merged scheme course extremely insightful, and it gave me the opportunity to test my understanding of the changes with short quizzes. The course simplifies the guidance released by HMRC and is easy to understand. I would recommend the course to all advisors/accountants.

Kevin Johnson

The course was enjoyable, informative and highly relevant to changes coming into the scheme from 1st April. I particularly liked how any past scheme rules were explained first, so any new changes could be appreciated more. A well worthwhile investment (of an hour and a half) of my time to keep up to date, and my own CPD plan.

Bradley Goddard

There was a nice balance between the complex, technical information and easy to understand graphics that I felt would be well received by people with all levels of R&D experience.

Tim Holmes

The content in the free trial is well worth the time to go through and view all the modules. Look forward to more.

Jana Kompusova

The R&D Community is very informative source for getting to know about R&D Tax reliefs. It is easily understandable and definitely can learn a lot from this course!

What does it cover?

Unit 1 & 2: The Merged R&D Scheme

- Key facts about the Merged Scheme

- How to handle grants and subsidies

- Subcontracting under the Merged Scheme

Unit 3: Costs & Financial

- Which costs attract relief in the Merged Scheme

- Restrictions on foreign subcontractors & EPWs

- The PAYE & NIC cap

Unit 4: Rules & Regulations

- Rules & regulations when giving advice on R&D tax relief

- The rules and deadlines for Prenotification

- Where to find further support and training

About the course

Built for Beginners and Experts

The course is exactly what it says on the tin – an Essential Guide. So you’ll find it helpful whether your still gaining experience in R&D claims, or you’ve been preparing them for years.

We’ve had feedback from accountants with 10+ years in the industry that the course helped them understand and apply the new rules. So why not join them and take the training?

Common Questions

-

You need to give us your name and email and when you sign up, but we don’t ask for any payment or card details – the course is completely free. You’ll also be asked to set a password for your account.

You’ll then get access to our training portal, and we’ll email you with more information about the course and The R&D Community so you get the most out of it.

-

No! We don’t take payment details or automatically upgrade you to full membership.

We know not everyone can decide independently to join the community – you may need sign off from others in your organisation. Our free course allows you to you experience our training first-hand, without worrying about cancelling or getting prior agreement internally.

If you do want to become a full member, you can sign up at any point.

Sign up for our free course

Trusted by our Community