For many, that can make it difficult to be confident in their skills, perhaps leading to extra time spent looking up and double-checking information, less effective conversations with clients, or even a higher risk of ‘giving in’ to an HMRC enquiry that might have been successfully defended.

Through the Certification in R&D Tax Relief, we can get a unique look at the topics where advisors feel confident, or not, and compare that against their scores in a diagnostic test designed to show them their strengths and weaknesses.

We’re also able to compare both confidence and attainment scores from before and after completing the certification programme, to get an idea of the improvements advisors can see after a bit of focussed study.

How confident are advisors in their knowledge of 6 core topics in R&D tax relief?

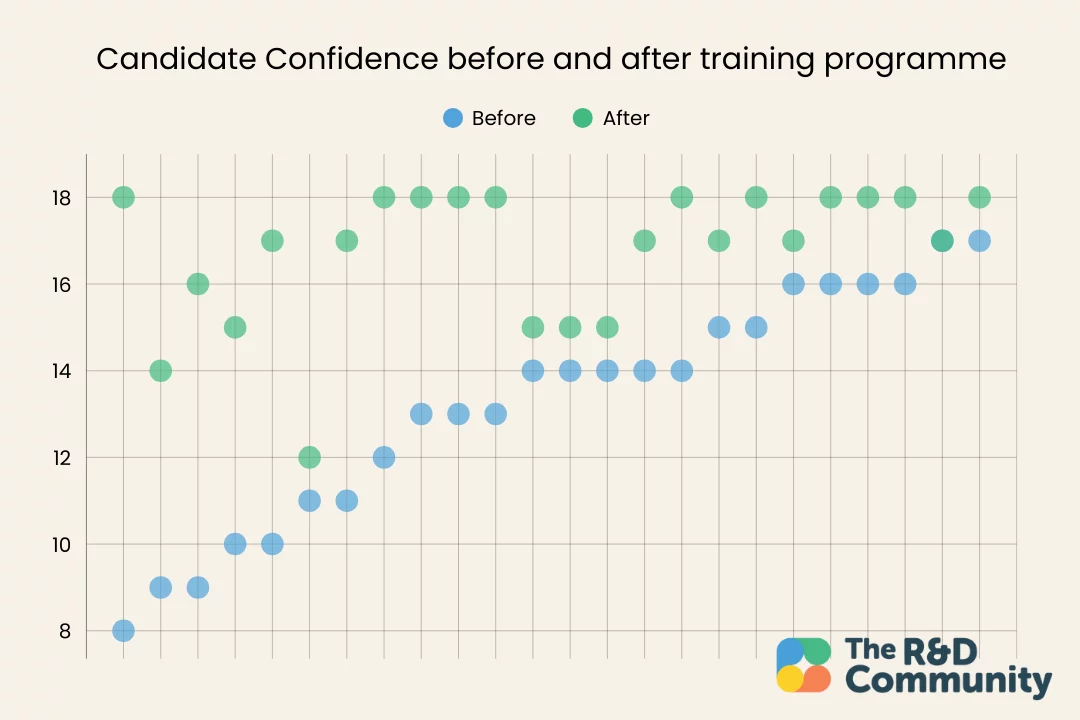

Across the last 2 cohorts, 24 people took the time to rate their confidence before and after the programme on each of the 6 topics. The latter survey isn’t mandatory, so a number of students don’t complete it at the end of the programme.

We asked them to rate their confidence on each of the six topics on a three point scale – Less confident (1), Pretty confident (2), or Very confident (3). With these ratings, the minimum score was 6, and the maximum was 18.

The graph above shows the paired confidence scores of each person from the two surveys. The average before was 13.1, and after it increased to 16.6. Except for one person, everyone showed improved confidence in at least some areas – the largest increase was from a score of 8 all the way to 18!

We were pleased to see that even advisors who started the programme with high confidence scores showed an improvement over the 13-week training programme.

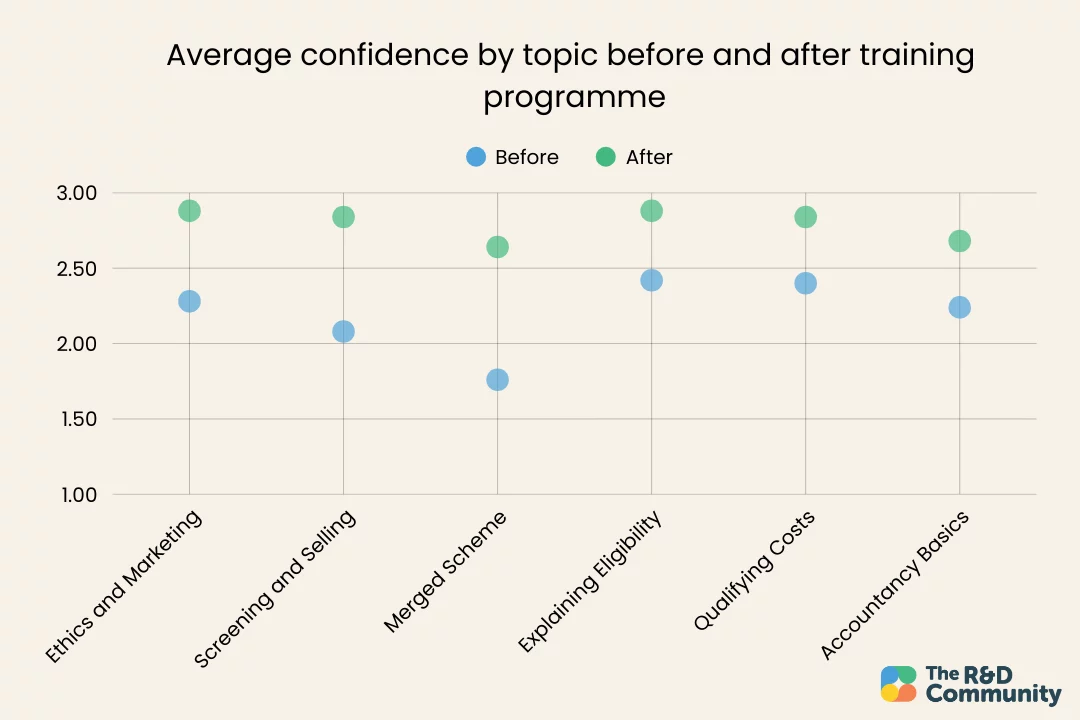

Next let’s look at the data for each of the 6 topics. As you can see, the data shows some interesting trends.

The data shows us that advisors were least confident in their knowledge of the Merged (new RDEC) Scheme both before and after the training programme. However, this was also the area where their confidence increased the most. When we explored this further, a number of candidates told us they were keen to take the Certification programme specifically because they wanted to update their knowledge on the new R&D schemes and rules. With that in mind, it’s not surprising that this was the area in which they felt least confidence.

For all 6 topics there was an improvement in confidence scores, starting with an average of 2.2 and ending with an average of 2.8.

Related: Prospectus for the Certification in R&D Tax Relief

Is your confidence as an R&D advisor misplaced?

Of course, what we all really want to know is whether or not an advisor’s confidence bears any resemblance to their actual test scores!

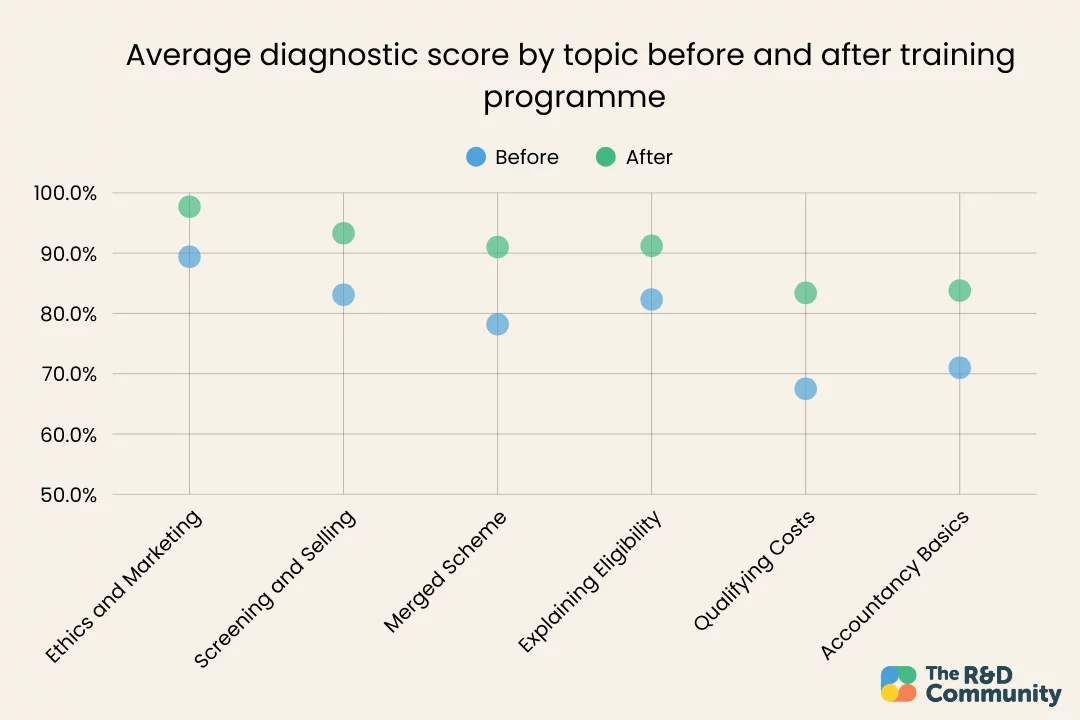

Following the qualitative “confidence” survey, candidates are also given a diagnostic assessment to complete before the programme, and then again during the revision period before the exams. Again, the latter instance isn’t mandatory, so the data here includes 64 “before” results and 43 “after” results.

The point of the assessment is to help them understand which areas may require more attention during the programme or revision before they take the final exam.

The graph below shows the average assessment score for each topic both before and after the programme.

As you can see, there’s a different trend here compared to the confidence data! People performed better in the section on the Merged (new RDEC) Scheme than in either the Qualifying Costs or Accountancy Basics sections of the exam, even though they typically were more confident in their knowledge of the latter too.

What can R&D advisors learn from the data?

As an advisor, the key message to take on board here is that it’s possible you know more than you think in some areas of the scheme, and less than you think in others!

If you’re part of a training programme or CPD scheme for R&D already, then its worth making sure you cover a variety of topics in your training, not just leaning to the areas which ‘feel’ tricky for you.

You may find it interesting to look at the 4 most common questions people got wrong in the diagnostic assessment, which might give you an idea if these are problem areas for you too.

If you aren’t already part of a structured training programme for R&D tax relief, the Certification programme could be a great fit for you and your team. It provides a training course, required reading and a live Q&A session for each of the 6 topics, as well as on going support, revision materials, and externally moderated exams. Successful candidates finish up with a certificate they can use to show potential clients or employers something tangible to reflect how much they really know about R&D Tax Relief.

Download the prospectus for the Certification in R&D Tax Relief