To help with this, we’ve developed an R&D Screening Template, which allows you to set your own criteria for screening prospects, to help you find the ideal leads for your business.

Once you’ve downloaded the template, you can follow this step-by-step guide to set it up and use it on your list of prospects.

How the scoring works

On the first page of the template, you can assign a value to each of the various factors in the screening tool, depending on your organisation’s priorities. For the first 3 categories – sector, size and turnover – the information should be straightforward to find on their website or Companies House. If there are any types of clients you absolutely wouldn’t consider, you can give that a score of 0, which means they’ll be excluded from your prioritised list.

The next 3 categories – grants, previous claims, and intangible assets – are clues about the type of work a company is doing, but they are much harder to find information for. If these aren’t factors you want to worry about, you can score them 0, and the calculation will not include them as ranking factors.

What factors to consider when screening a prospect for R&D tax relief

Let’s look at each of the categories in a little more detail.

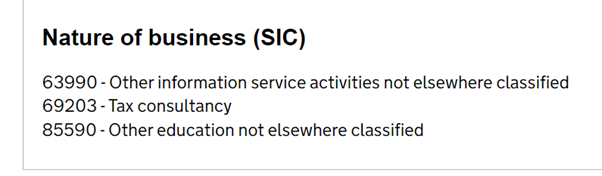

The Sector is the first listed category, and the easiest to find information on. When you look them up on Companies House, you can easily see their SIC code, which will tell you about their sector. You can also check on the company’s website, to make sure their current work is in line with that SIC code too.

If you need help deciding what sectors to prioritise, HMRC have published data on the sectors which have the most claims and the highest claim value. You can use this data to inform your own weighting.

Company Size and Turnover matter because they can affect which R&D Scheme the company can claim under, which affects the potential value of the claim. For claim periods beginning before 1 April 2024, companies have to claim under the SME scheme, or the less generous RDEC scheme, depending on the number of staff and their turnover. Later claims will be made under the Merged R&D Scheme, or potentially the ERIS scheme. The latter is only available to SMEs, so company size is still a factor.

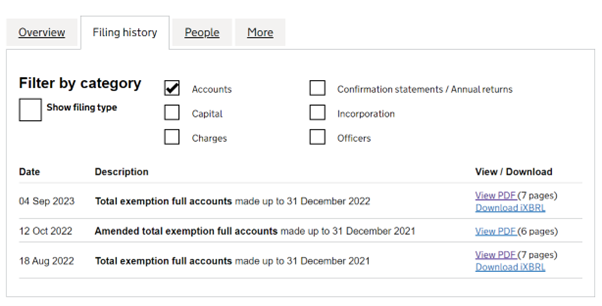

As a general rule you can find these details in the company’s tax returns filed with Companies House.

How to know if a company is running R&D projects

It’s not usually possible to know for sure if a company is running R&D projects, and indeed if those projects would qualify for relief. But there are a few clues you may be able to find buried in the company’s accounts.

The last 3 categories – grants, previous claims and intangible assets – are sometimes also found in the accounts filed on Companies House. This is determined by company size – larger companies are required to file complete accounts, but small companies only need to file abbreviated accounts, which won’t show these details.

If the prospect is large enough to need to file full accounts, these are likely to show grants and intangible income. Whether or not an R&D claim is disclosed in the accounts may vary depending on accounting practices, so you may have to look at the accounts quite closely to find it.

Each of these three factors is a clue to whether or not a company might be doing R&D work, if that work might be eligible for relief, and whether or not the claim will be large enough to make commercial sense for your business.

How you treat these factors depends on the type of clients you’re looking for, so in the spreadsheet you can decide what weight to give to each one, as per your own priorities.

Grant funding

First, let’s talk about grants. As we discuss in detail in our course on Qualifying Leads, the size and type of grant funding received will impact the scheme which the client can claim under, and how much their claim is likely to be worth. So, if you’re looking to help them claim for that past accounting period, those are essential factors to consider. On the other hand, if you’re looking to support them with newer claims, you won’t know until you talk to them if they are still receiving grant funding and what that’s worth. But the grants in previous years can be a strong indicator that the company is undertaking R&D projects of some kind, which could make them a stronger prospect that someone who’s never received a grant in the past.

Previous R&D claims

Next, previous R&D claims – if these are shown in the accounts it can again give you a clue that the company might still be doing qualifying R&D. It also means that the client is likely to know more about the process and requirements of claiming, which can make it easier to prepare the claim for them. It also means they may have an existing claim provider, so you’ll likely have a different conversation with them than you would with a prospect who has never claimed before.

Intangible assets

And finally, intangible assets are relevant because they reflect the intellectual property of the company. And intellectual property is often the outcome of R&D projects – so if they have it, it’s likely they’ve conducted R&D at some point. So again, it’s a clue that they may still be doing eligible work, or may have past projects that could still be claimed for.

Using the R&D screening template to prioritise your list of prospects

Once you’ve assigned your weighting values to each category on page 1 of the spreadsheet, you can then move on to page 2. There’s some sample data in there to show you how it works – you can remove these and add in your own list of prospects.

As you then research each company, you can select the relevant response to each category in the columns going across, and the final column will calculate the priority rating of each one as you go.

Where you’ve given a 0 rating to an industry sector, company size or turnover, those companies will always score 0 in the calculation, so you know there’s no need to follow up.

For the others, they’ll get a higher score when they have more of the positive factors you’ve identified, and they’ll be colour coded for an easy visual reference.

Once you’ve been through your whole list, it will then be easy to sort who has the highest score, and in this way, prioritise your list of prospects to start with the strongest candidates first.

If you’re ready to get started, make sure you download your free copy of the R&D Screening Template.