For example, HMRC recently published its long-awaited ‘Guidelines for Compliance’. While these are pretty lengthy, they’re surprisingly positive in tone. In fact, many of the examples they use show that HMRC’s Policy team seems to be taking a fairly open and generous view of the programme. This seems very similar to their tone from a few years ago, when HMRC seemed much more open-minded about the types of projects that qualified. (We’ll be covering the guidelines more extensively in the New Year, so keep an eye out for new articles and updates on that front.)

The 2023 Autumn Statement

The Chancellor’s Autumn Statement was presented on the 22nd of November. An accompanying Technical Note contained new information about upcoming changes to R&D tax relief, and in particular, the new, merged R&D scheme.

In terms of dates:

- The Merged R&D Tax Relief Scheme will apply to accounting periods beginning on or after 1 April 2024;

- The Scheme for R&D Intensive Loss Making SMEs will apply to expenditure incurred on or after 1 April 2023, and

- The existing SME and RDEC schemes will continue to apply to accounting periods starting before 1 April 2024.

Here is a breakdown of the key information about the Merged and R&D Intensive schemes.

Merged R&D Tax Relief Scheme

Who’s it for?

- Large Companies and SMEs (excluding Loss-making, R&D-intensive SMEs)

Which APs?

- Accounting periods starting on or after 1 April 2024

Rate

- 20% Gross Credit (SPR rate applied to loss makers, main rate applied otherwise)

Key features

- Customer claims for subcontracted activities that are part of their R&D

- Subcontractors can claim if:

- it was their decision to undertake R&D (not the customer’s) OR

- it was the customer’s decision to undertake R&D, but the customer wasn’t a UK-taxpayer

- The receipt of a grant or subsidy does not affect or reduce the claim for R&D tax relief

R&D Intensive Scheme for Loss Making SMEs

Who’s it for?

- Loss-making SMEs with either 40%/30% ‘relevant R&D expenditure’ for the period

Which APs?

- Expenditure on or after 1 April 2023 – 40% relevant R&D expenditure threshold

- Accounting periods on or after 1 April 2024 – 30% relevant R&D expenditure threshold

Rate

- 86% Qualifying Expenditure Enhancement and 14.5% Credit on Surrenderable Losses

Key features – Expenditure on or after 1 April 2023

- Contracted out R&D: CIRD 84250 – Any activities carried out in order to fulfil the terms of a contract are considered to have been contracted to the company and do not attract relief. HMRC likely to challenge claims under the SME scheme where a customer is involved.

- Subsidised expenditure is not allowable under the Intensive scheme.

Key features – Accounting periods starting on or after 1 April 2024

- Customer claims for subcontracted activities that are part of their R&D

- Subcontractors can claim if:

- it was their decision to undertake R&D (not the customer’s) OR

- it was the customer’s decision to undertake R&D, but the customer wasn’t a UK-taxpayer

- The receipt of a grant or subsidy does not affect or reduce the claim for R&D tax relief

- Grace Period: A company making a valid claim in one 12-month accounting period can claim the intensive relief in the following accounting period even if the intensity threshold is not met

There was also some important information about Removing Nominations and Voiding Assignments:

When?

- No new assignments of R&D Tax Credits will be possible from 22 November 2023

- Nominations for a third-party payee to receive R&D Tax Credit payments will no longer be allowable from 1 April 2024.

The Technical Note also clarified one of the most contentious parts of the SME scheme: whether companies can claim R&D tax relief when acting as a subcontractor. Before explaining the good news, let’s take a quick recap of how HMRC has viewed the issue for the last couple of years.

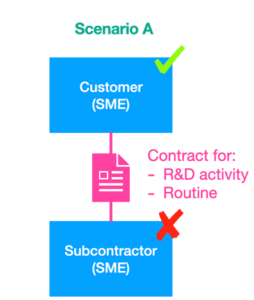

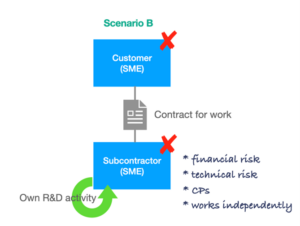

HMRC’s current approach

Scenario A is uncontentious. When your client is the company commissioning a subcontractor to perform part of its R&D project, your client can claim relief. The subcontractor isn’t allowed to claim, which prevents ‘double dipping’.

Scenario B, on the other hand, has been more problematic. This occurs when the customer instructs a subcontractor to provide a good or a service, and there is no mention of or apparent need for R&D. As far as the customer’s concerned, it’s routine work. In some cases, the subcontractor may decide to invest in its own R&D. This may be to make an advance in technology that can be used to satisfy its current contract and others like it in the future. The subcontractor typically takes the financial and technical risk of the speculative development, and it works independently from the customer on the side-project.

Unfortunately, HMRC has typically applied the rules from Scenario A to Scenario B. It tells the subcontractor “Sorry, you can’t claim because the R&D was contracted to you” and it tells the customer “Sorry, you can’t claim because you didn’t have an R&D project”. So, while R&D has clearly taken place, neither party can claim! This approach has often been the source of deep frustration to many R&D advisors and their clients.

HMRC’s approach in the new, merged scheme

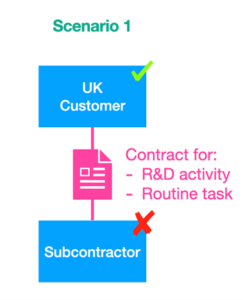

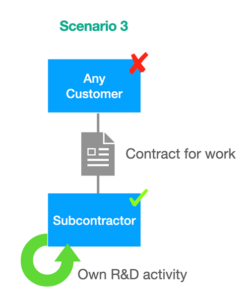

For accounting periods starting on or after 1 April 2024, things are going to be different as HMRC acknowledges the issues described above in Scenario B. Going forward, there will be three main scenarios to consider.

Scenario 1 – Customer is UK-taxpayer and decides to do R&D

This is pretty much identical to Scenario A. HMRC says that the company deciding to undertake the R&D gets to claim, which in this case is the customer. The subcontractor cannot claim.

Scenario 2 – Customer is non-UK taxpayer and decides to do R&D

In Scenario 2, HMRC is recognising that there are cases where it’s impossible for the customer to claim. For example, they could be based in a foreign country, or be a UK-based organisation that’s not subject to Corporation Tax (such as the Ministry of Defence). Where R&D has been contracted by an entity that can’t claim relief, the subcontractor is allowed to claim relief instead.

Scenario 3 – Subcontractor decides to undertake R&D

In Scenario 3, a customer (whether UK-based or not) engages a subcontractor to undertake some routine piece of work. This would usually be the delivery of a product or service. Nothing in the contract, or the surrounding business context, mentions the need for R&D. In some cases (probably a minority), the subcontractor may decide to invest in its own R&D. The results of that would typically be used not just to satisfy the contract it has with its customer, but also any similar contracts it may win in the future. In this scenario, the subcontractor is able to claim R&D tax relief.

This is a huge step forward for HMRC. They finally recognise that subcontractors often have solid grounds on which to submit an R&D claim, even when they’re working for a customer.

The main problem right now is that the scenarios above relate only to accounting periods starting on or after 1 April 2024, and HMRC’s Compliance teams are continuing to cling to their current doctrine – that if there’s a customer involved, the subcontractor cannot claim.

Looking ahead

While HMRC is taking welcome steps towards a more pragmatic scheme that supports the companies who decide to do R&D, there’s still a huge amount of nuance and complexity for advisers to deal with. Even in the scenarios above, whether the customer or the subcontractor will be able to claim will come down to the wording of the contract and the surrounding circumstances and business context. So, unfortunately, advisers will still have to deal with a great deal of complexity even when all claims are made through the merged scheme.

The announcement of all of these changes capped off a very eventful period for R&D tax relief. The start of the year saw drastic changes to how HMRC approached compliance, and many advisers and their clients found themselves unsure of how to best navigate the changing landscape of the industry.

HMRC also brought in new requirements for R&D tax relief claims – prenotification and the Additional Information Form. If you’re unfamiliar with these or need a refresher, we published articles that give you a general overview of their impact and what steps you should take to incorporate them into your processes. We also developed a new training course that is dedicated to the Additional Information Form, covering it in detail and featuring templates that you can use to help fill it out.

- Do I need to prenotify my R&D tax claim?

- Get prepared for the Additional Information Forms for R&D tax relief

- Training course – How to complete HMRC’s Additional Information Forms

While the introduction of these measures was publicised by HMRC, many advisers felt confused at the flurry of rule changes and new information. To help out, we produced a raft of easy-to-digest articles and guides. Below are some resources that cover the most important aspects of R&D claim compliance in more detail:

- Technological uncertainties and eligibility: under the microscope

- Software projects and eligibility: interpreting HMRC guidance

- Adapting your claim methodology for 2023 and beyond

- Documentation requirements for R&D claims: best practice for meeting heightened standards

- The importance of a clearly defined technological baseline in an R&D claim

Finally, another major change came in how HMRC treats the claimant companies themselves. While an R&D claim has always been the client’s responsibility, penalties and enquiries were much less common in previous years. Claimants could afford to be a bit more hands-off, but now that penalties and enquiries are a very real possibility, that isn’t really the case.

Working closely with clients is now a requirement for stronger R&D claims. Don’t worry if you’re not quite sure how to adapt your approach; some of the articles below cover that in a bit more detail and can also be useful for your clients in getting up to speed.

- Working with clients to adapt to HMRC’s new approach to R&D

- The basics of R&D Tax Relief for SMEs

- Key mistakes to avoid as an SME claiming R&D tax relief

We’re always looking for new ways to support our members and help raise standards in R&D tax relief, with a core part of that being the development of new online training courses. Our course catalogue is the most comprehensive collection of R&D tax relief education currently available to advisers and accountants. We’re confident in the value that it could bring to your business. If you want to learn more about how to join The R&D Community, check our pricing page for a full breakdown of membership benefits and costs.

If you’re not sure whether our training is right for you, we have a free Taster Course that’s perfect for dipping your toes in.