Was this an accusation of fraud?

These letters caused considerable concern for recipients by stating that an alert on HMRC’s systems had “caused HMRC to believe that you have fraudulently claimed money to which you are not entitled” and by referencing “suspected fraud”. As you would expect, most claimants did not like being accused of committing fraud. However, despite how most would interpret the language used, in subsequent Research and Development Communication Forums, HMRC stated that the letters were not outright accusations of fraud.

Nicola Newbury expanded on this in the House of Lords Finance Bill Sub-Committee meetings in the winter of 2022, saying that the letters were issued for claims exhibiting “multiple hallmarks of fraud”, which had triggered HMRC’s fraud monitoring systems. She added that once satisfactory supporting information was provided, the claim could proceed as normal. She acknowledged that receiving such a letter was distressing, but HMRC felt the wording of the letter and the approach was proportionate and justified.

While the question remains whether these letters constitute direct allegations of fraud, it seems evident that more carefully crafted wording might have avoided some of the distress caused by any legitimate claimants receiving such a letter.

What started this FIS campaign?

We now know that in April 2022, HMRC identified a criminal attack on the research and development sector.

HMRC has described this as a “scaled organised criminal attack on the R&D regime.” Advisers will recall that HMRC paused all R&D payments at this time. Little detail of the precise nature of this attack has been released, but in October 2022, The Times reported on the arrests of eight individuals who were alleged to have arranged more than 100 sham R&D claims worth more than £16 million. These arrests included a tax agent suspected of criminally assisting with the fraudulent R&D attack. HMRC FIS officers helped facilitate these arrests.

HMRC has since confirmed that the above attack was the catalyst for the FIS letter campaign, which they call the ‘Red Letter’ process.

Over the years, HMRC has faced numerous attacks and challenges from organised criminal gangs, so they continuously monitor for the hallmarks of fraud or an attack. In response to the April 2022 attack, they strengthened their automatic risk assessment process to spot any further similar attacks, incorporating new fraud risk indicators likely derived from patterns observed in the above attack. Subsequent claims exhibiting those hallmarks would likely have been flagged for an FIS letter. In the early confusion of this campaign and in a desire to act quickly, it was understandable that some legitimate claims were inadvertently picked up. However, as time passed and more data was accumulated by HMRC, you would hope that the risk assessment process improved and less genuine claimants would receive such letters.

When were these letters issued?

In our experience, these letters have been issued in waves by FIS, beginning on 15 June 2022. We’ve heard of FIS R&D letters being issued on the following dates:

- 15 June 2022

- 22 June 2022

- 14 July 2022

- 11 January 2023

- 12 July 2023

- 14 August 2023

- 8 September 2023

- November 2023

- 15 January 2024

How many of these letters have now been issued?

In November 2022, HMRC said that they’d issued over 1,600 of these letters to high-risk claimants. Of those 1,600 letters, 80% did not respond to HMRC, and 15% warranted further investigation because their claims did not look legitimate.

That number had increased to 2,000 by April 2023 and 2,500 by July 2023.

In the latest update provided by HMRC on 15 December 2023, they said that they had, by that point, challenged over 2,800 claims via this process since it began and prevented the pay-out of £137 million. In that update, of those claims challenged, they said that:

- 80% sent no response,

- 17% led to further enquiry,

- and 3% were eventually paid out.

Our experience of outcomes

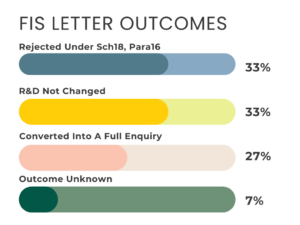

Avalon Tax has been shown various FIS letters from claimants and advisors, and details of the outcomes have been shared with us. Our experience of the outcomes for legitimate claimants differs somewhat from HMRC, but this is understandable, as you would hope that HMRC’s statistics include mostly illegitimate claims. Of the 17 FIS letter cases we have seen, claimants had the following outcomes:

Where HMRC used Schedule 18, Paragraph 16 FA 1998 to remove a claim, this was done quickly. Our analysis shows that HMRC typically took this action between 6 and 12 weeks from the date of sending out the FIS letter.

Unfortunately, of those claims rejected, most failed to respond within the strict 30-day time limit, because of a belated receipt of the original FIS letter. However, we’ve seen other cases where a response was submitted to HMRC within 30 days, and HMRC still rejected the claim under Schedule 18, Paragraph 16.

Whichever statistics you use, these numbers show that most claimants receiving an FIS letter will either have their claim rejected or a further full and lengthy enquiry opened. Only a minority have their claim paid out unchanged and as originally submitted.

A noted recent change of practice by HMRC that we’ve seen from the end of 2023 is to accompany the rejection notice (CT620 COR) with an ‘explanatory’ letter from the Anti-Abuse Unit. However, the explanations provided are sparse, essentially just repeating part of the wording from the original FIS letter and adding that HMRC concluded the claim was invalid.

The legitimacy of using Schedule 18, Paragraph 16, in these circumstances, when this was only historically used for correcting obvious errors, is currently contested by most advisers and the CIOT, but we don’t intend to cover that in this particular article. In most cases, a rejection under Schedule 18, Paragraph 16, can be displaced by resubmitting the claim before the normal amendment deadline expires or within three months of the rejection notice in other cases. As such, the need to challenge its use is unnecessary for most claimants as it can be displaced relatively easily. However, our experience shows that a resubmission of a claim following rejection usually results in a formal enquiry being opened by HMRC’s WMBC department.

Is there any indication of what types of claims are triggering these letters?

Understandably, HMRC has not been prepared to share any specific details about what types of claims are triggering a potential fraud alert on their systems.

However, HMRC has said that some company identities were hijacked as part of the original attack.

Our analysis of the letters we have seen shows that the use of a repayment nomination to a third party was present in some cases. This factor may have contributed to triggering a FIS letter from HMRC. In the R&D Policy Paper issued alongside the 2023 Autumn Statement, HMRC noted that “a high proportion of fraudulent or fraud-adjacent claims use nominee bank accounts”.

In addition to this, we have also identified other common characteristics and notable trends among the claims being scrutinised by the FIS, including the commonality of certain trade sectors. However, to maintain the integrity of the process and avoid the potential misuse of this information, we won’t be sharing the precise details of these attributes in this article.

Is the campaign continuing?

The distribution of FIS letters to claimants in January 2024 demonstrates that this campaign is, indeed, still continuing. The latest letters appear virtually identical to the initial batch issued in June 2022.

It is somewhat disheartening to see that the language being used remains unchanged, continuing to cause distress among bona fide claimants who receive these letters. Perhaps a more nuanced phrasing, such as “Your claim shares certain characteristics seen in fraudulent claims received by HMRC…” rather than “ …you have fraudulently claimed”, might be more appropriate. This is not solely a matter of being sensitive to people’s feelings. The current approach risks tarnishing HMRC’s credibility, and the potential for incorrect allegations of fraud could actually impede HMRC’s ability to execute its duties properly.

The decision to eliminate nominee usage, as announced in the Autumn Statement, coupled with the impending reforms at Companies House, is likely to help mitigate some risks in this area for HMRC. These measures may reduce the necessity for some FIS activity. However, despite these changes potentially having some positive impact, we anticipate that other types of attempted R&D fraud will continue and that HMRC’s FIS R&D campaign will continue into 2024 and beyond.

What should I do if my client receives one of these FIS letters?

If a client receives one of the above-mentioned letters from HMRC’s Fraud Investigation Service regarding their R&D claim, it is crucial to approach the situation promptly, with diligence and clarity. Here are some suggested guidelines:

- Double-check the legitimacy of the claim and claimant: Begin by re-confirming the authenticity and accuracy of both the claimant and the claim. If there were any ‘amber’ concerns raised during the original client onboarding or Anti-Money Laundering verification process, it is prudent to re-evaluate these aspects. You don’t want to be attempting to defend a claimant or claim to FIS if anything is less than perfect. FIS can quickly move a case to a criminal investigation if there is any genuine evidence of fraud. The consequences of this, both financially and reputationally, can be huge, in addition to the fact that your client could potentially be facing a custodial sentence if genuine evidence of fraud is found.

- Respond promptly: If the claim is verified to be accurate and all in order, as you would expect in all cases handled by R&D Community members, a prompt and thorough response to HMRC is essential. Adhere strictly to the 30-day response deadline to avoid an automatic rejection of the claim under Schedule 18, Paragraph 16 of the Finance Act 1998. Our experience is that such rejections can, in some cases, come within two weeks of the deadline expiring if no response is forthcoming. Provide all of the information requested by FIS to substantiate the validity of the claim, ensuring that your descriptions are concise and relevant. Be succinct when describing the advance in science or technology. Fully explain the reasons why any information is not being provided, such as the absence of a VAT number if a client is not registered.

- Manage client expectations: Prepare the client for the likely protracted timeline of this process. Typically, it takes 2-3 months to receive any indication of an outcome. In our experience, a rejection, if one is coming, will likely come at least a month before the time it takes HMRC to release any R&D Tax Credit if they are satisfied. If a formal enquiry is coming, that will usually be opened by WMBC around a month later. Payment release, if FIS is happy with what has been provided, can take perhaps three months or more after a response is provided, but don’t expect any communication from HMRC saying they are happy; simply the appearance of a payment one day. During this period, a lack of communication from HMRC can be considered normal, and in this respect, no news is good news. However, it is important to set realistic expectations with the client for the long time it is likely to be before all this is resolved.

- Navigating the enquiry process: Receiving this type of FIS letter can be daunting for both you and your client. However, thankfully, in many respects, it can be treated like any other HMRC enquiry. The R&D Community offers extensive guidance and resources to its members for handling such situations. Resources like ‘How to Prepare your Client for an Enquiry with HMRC’ guide and the general guide on ‘How to handle an R&D enquiry’ can be particularly useful.

While the receipt of a letter like this is clearly going to be very concerning for you and your client, approaching FIS enquiries with a methodical and informed strategy will not only help in effectively managing the situation but also in safeguarding the interests of both your practice and your clients.