Are they necessary? Yes, of course – it’s just HMRC doing its job to ensure that relief is only given to companies that genuinely meet the criteria. Are they a soul-sapping, hair-splitting exercise in technical disagreement that can trundle on for months before coming to an unsatisfactory (as far as your client’s concerned) conclusion? Also, yes. At least, much more so than they used to be.

If you’re reasonably active in making claims for R&D tax relief, you’ll probably be aware that over 2021 there’s been a big uptick in the number of HMRC enquiries. Evidence of this could be seen at the last meeting of the RDCC (Research & Development Consultative Committee), where there were more than a few anguished complaints along the lines of ‘Hey, why are you taking such a tough line with us? We wanted you to crack down on the other guys!’. So, why has everyone ended up in the firing line, and why is HMRC taking such a robust approach?

There’s an obvious answer to this, and a more subtle one too.

Taking the obvious one first, HMRC’s been criticised for quite some time for the way it policed the R&D tax relief scheme. Many people felt aggrieved that some claims management companies were pushing all kinds of claims through, with some very suspect. It didn’t seem fair that they were getting away with it, while other providers were trying hard to stick to the rules.

This rising feeling of unease, coupled with the National Audit Office flagging the estimated £300m that HMRC lose annually to R&D fraud and error, seems to have stung the tax man into action: HMRC reportedly hired 100 new Compliance Checkers to assess claims. So the first, obvious reason behind the increase is that there are just more people checking now.

The second reason isn’t as easy to see, and relates to how people learn to become R&D tax relief experts (or indeed, Compliance Checkers).

To illustrate this, let’s consider the enquiries I’ve been asked to review recently. From the outset, they looked defensible. The client was articulate, knowledgeable and clearly a Competent Professional in their area. The boundaries of the project had been well defined, the advance was clearly stated and the costs had been rigorously scrutinised.

And yet…every time, the enquiry eventually resulted in HMRC saying that none of the client’s work was eligible. Zero per cent. Nada.

As you can imagine, clients were deeply upset – not only were they losing their claim, but suddenly they were being asked to justify why they shouldn’t also be hit with penalties. Accountants lost hair and fees as a result.

So, how did strong claims come to be thrown out? While HMRC being tough on R&D is understandable (and welcome), concerns are emerging that even valid claims are now being disallowed alongside the more suspect. Why is this happening?

To understand this trend, we have to look at the learning curve of anyone approaching R&D tax relief for the first time (just like HMRC’s 100 new staff).

From my previous experience of building a team of 20+ R&D consultants, here’s the pattern that we saw time and time again: new consultants went through three distinct phases on their way to becoming expert.

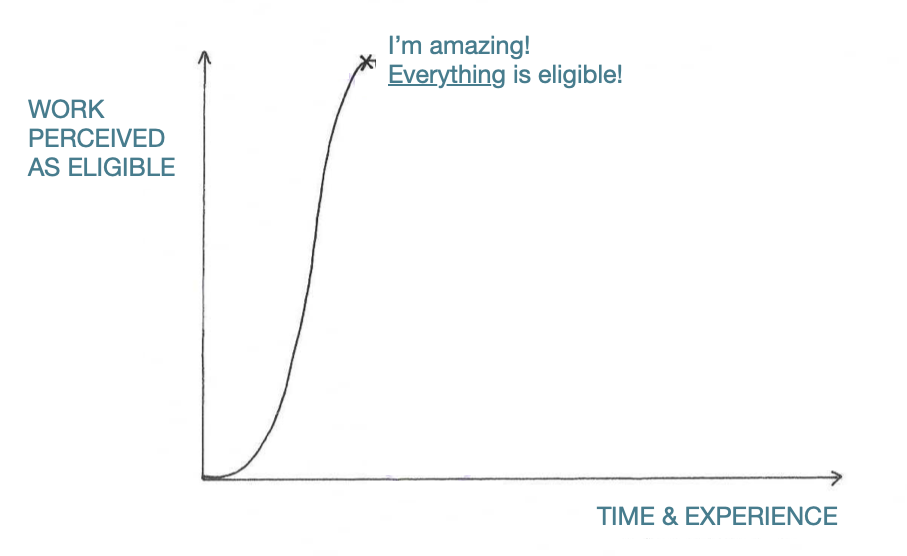

1. The Eligibility High

At the start, the recruit is enthused and excited by the possibilities – Hey, I can see eligibility everywhere! (This is also known as the ‘It’s Not Just White Coats and Test Tubes’ phase.) Every way you turn, you see eligible clients. It’s exciting.

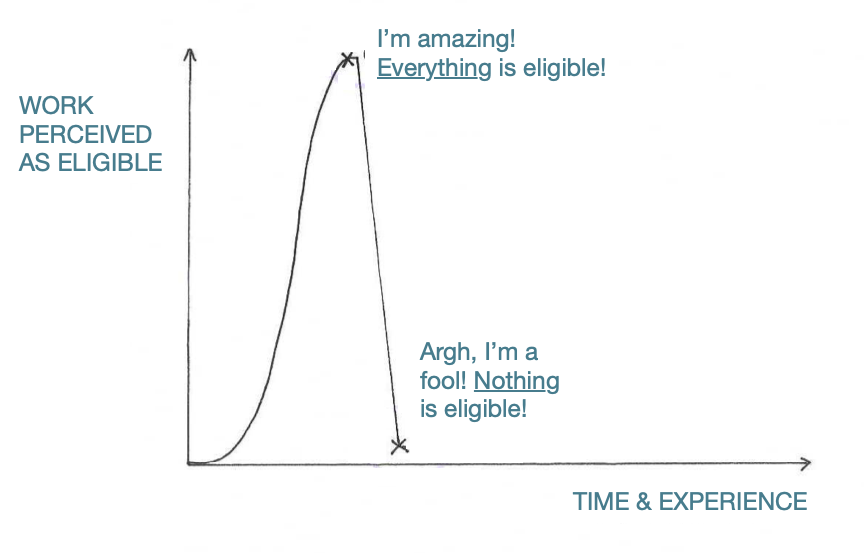

2. The Confidence Crash

Then something happens. Usually, it’s an enquiry into a claim they thought was fine – this makes the junior consultant really read the guidance. Closely. Multiple times. This usually triggers the reaction ‘Gosh, if this standard has to be applied literally, in its entirety…then almost nothing is eligible’. Confidence crashes, and it’s far easier to see the reasons why work is not eligible than why it could be. Maybe R&D really is white coats and test tubes after all!

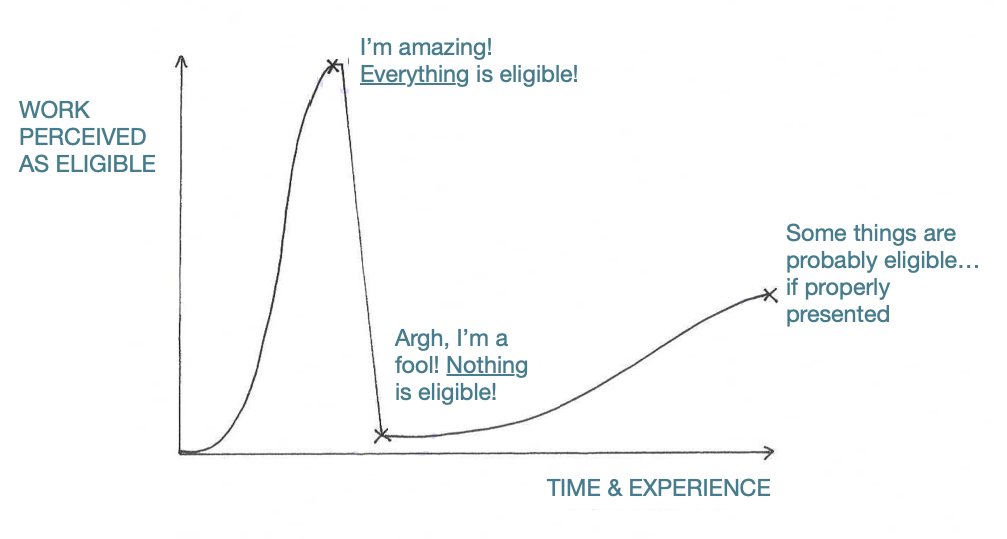

3. Professional Pragmatism

What happens afterwards is the long, slow process of the consultant learning how to apply the guidance with common sense. They learn to sift out the ridiculous and dishonest, while developing a healthy scepticism, respect for the spirit of the guidance, and an ability to represent the client’s work as positively as the facts allow.

Eventually, the consultant attains the stage of Professional Pragmatism, where they are able to make sensible judgements in a relatively impartial way, balancing the client’s desires with the realities of the scheme’s rules.

The Inspectors we dealt with years ago had this ability – they were good at stripping out the obvious No-Nos, but they also helped the claimant to understand the areas where they were eligible. It was give and take, rather than an out-and-out refusal of the relief.

As claim-refusals and penalties continue to mount, I suspect that HMRC’s 100 new(ish) Compliance Checkers are still at Stage 2 – they are applying the guidance rigidly and exactly, with little flexibility or pragmatism, which is why so many enquiries are proving unwinnable right now. Unfortunately, when using a standard as subjective and complex as HMRC’s definition of R&D, it’s always easy to find 20 reasons why something isn’t eligible – and HMRC only need one to refuse a claim.

This, then, is why training your team in R&D has never been more important.

Investing in effective training solutions can help avoid many of the issues that trigger enquiries in the first place, and if you are unlucky enough to be selected, a consistent, well-drilled team is going to be able to contain the damage better than one that’s unsure what to do.

You can find out more about all the training options on the market in our free guide to R&D Tax Relief Training. We have a members-only Training Academy too.