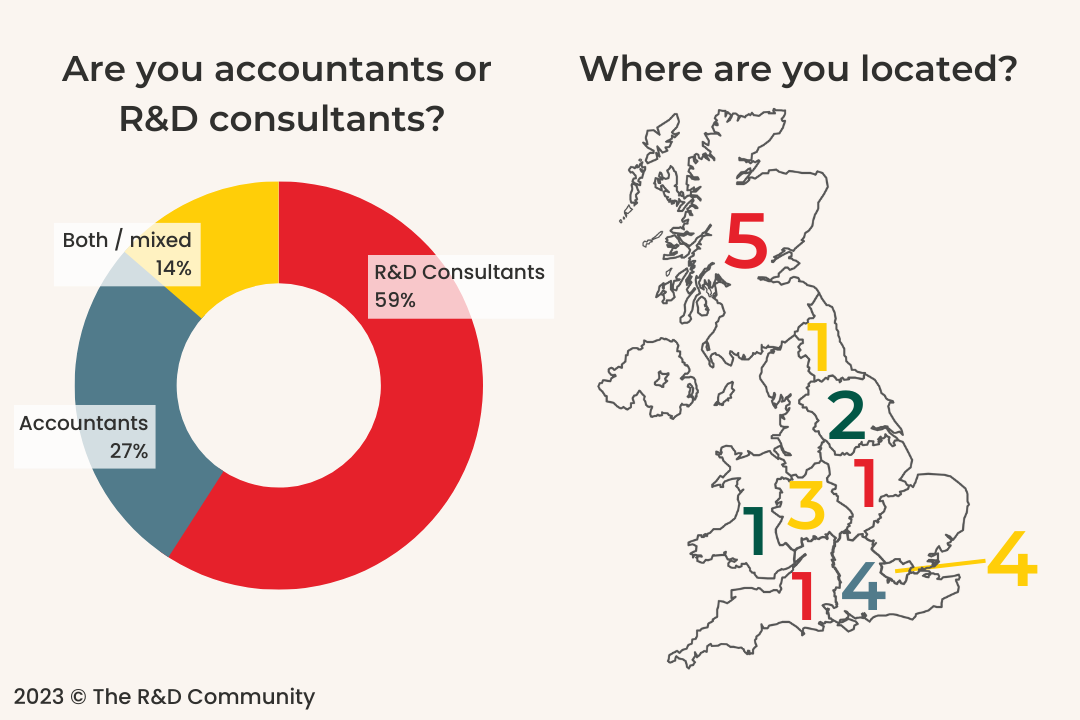

We had 22 responses from among our 60 member organisations, who represent a wide range of R&D tax relief advisors.

We asked questions about their companies, their priorities, their fees, and their thoughts on membership. In this article we’ll give you the highlights of the data, along with some thoughts about how our members reflect industry trends more broadly.

Which of our members took part?

Our members are a varied group of accountancy firms and R&D consultancies, based all over the country. Here’s how that breaks down across the 22 firms who responded.

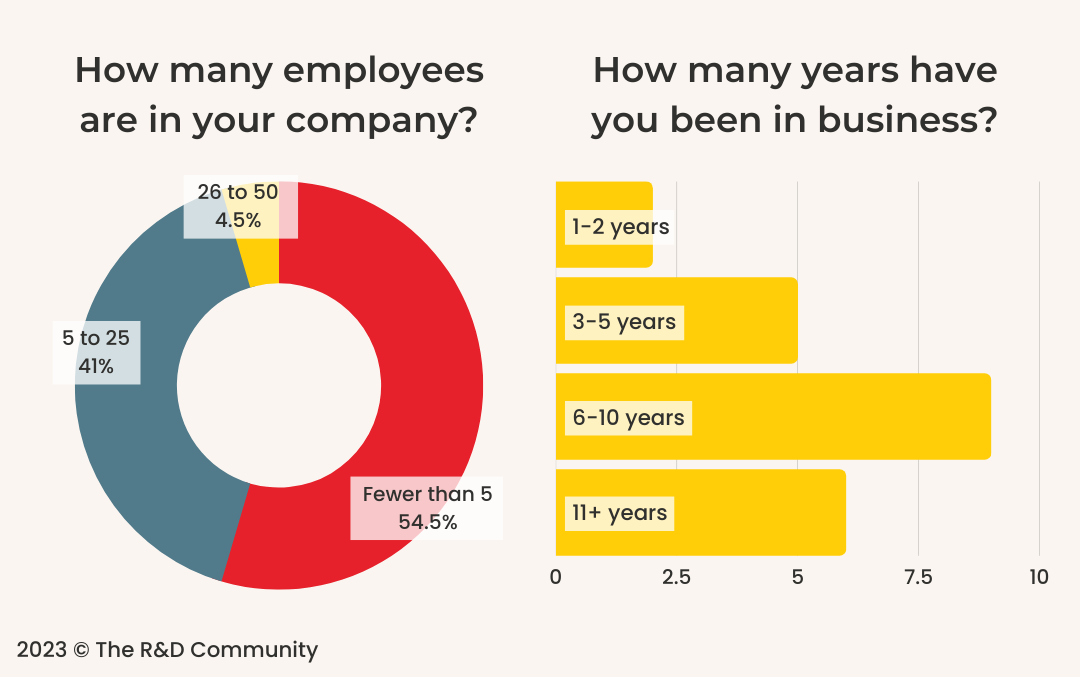

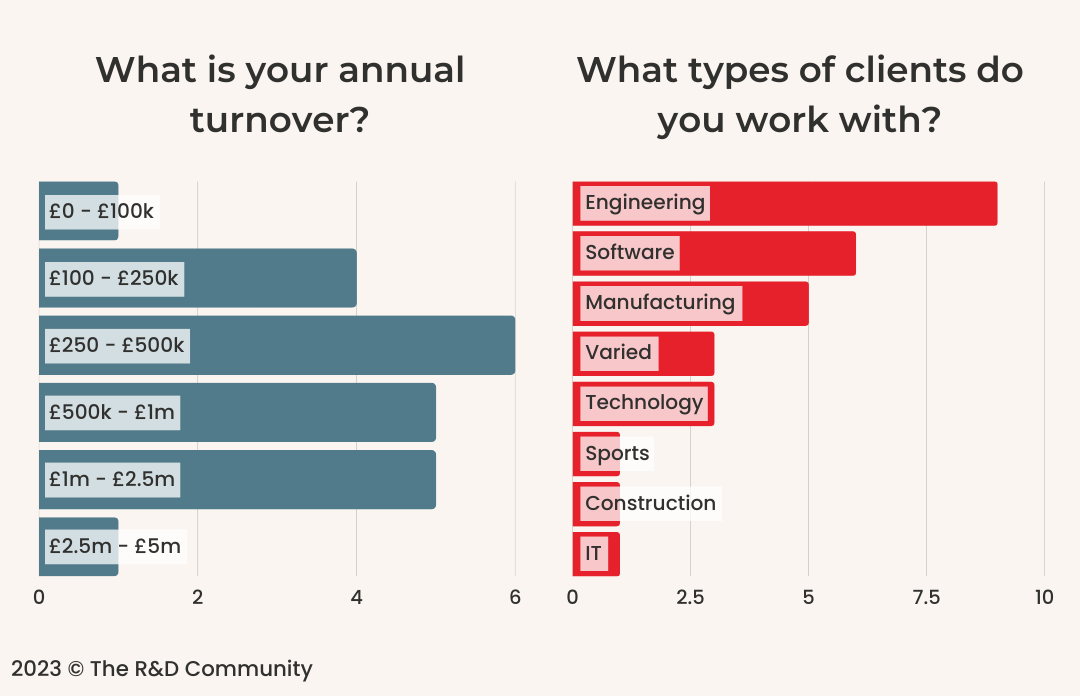

Our members vary in age, size, turnover, and the types of companies they support.

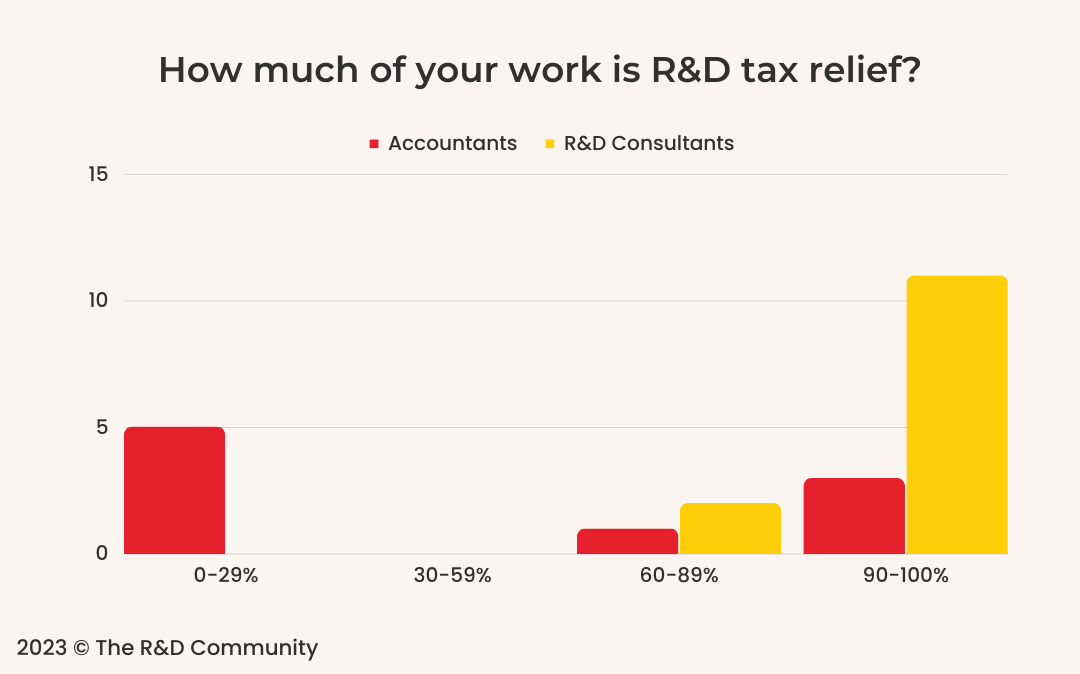

We also were interested to know what percentage of their work is R&D tax relief.

It’s a relatively small sample size, but with so much variety included, we believe the data still has a lot to tell us about trends in the R&D industry as a whole.

What matters to R&D tax relief advisors?

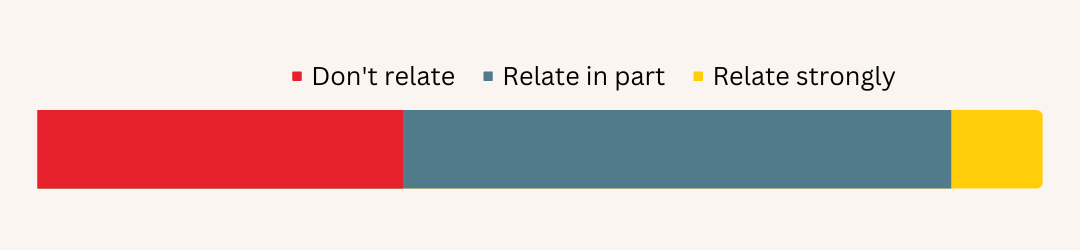

One of the most important things we wanted to learn about our members was what mattered to them. So, we asked them how strongly they related to six different statements that reflect different areas of concern.

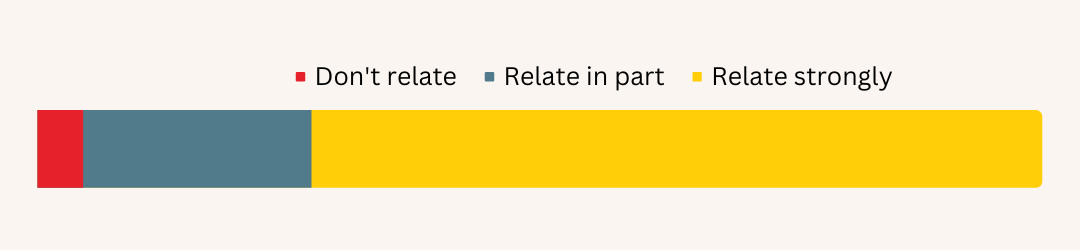

I’m really concerned about the big picture of R&D tax relief, and would like to be involved in efforts to improve industry standards.

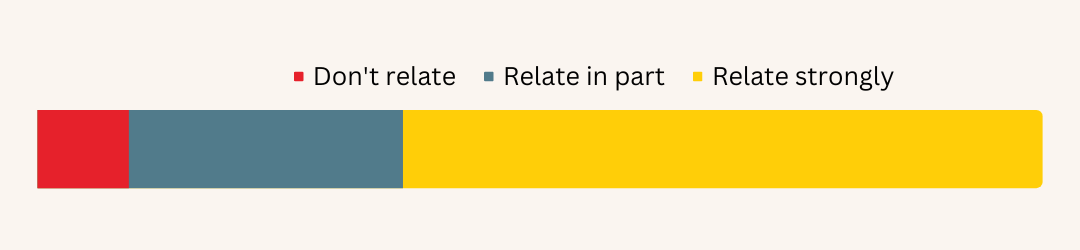

We want to learn more about R&D and improve the service we offer.

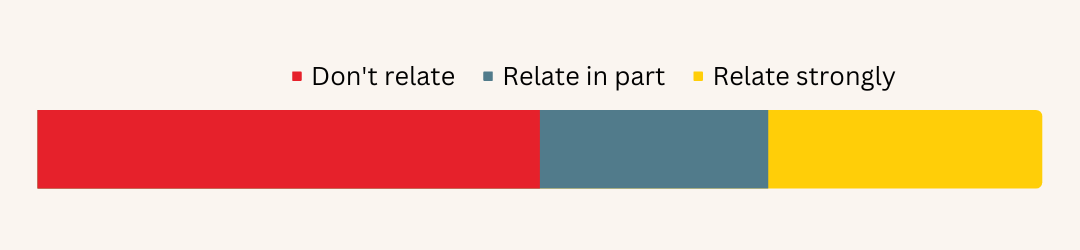

We’re focussed on winning and retaining clients to make sure the service is sustainable or profitable.

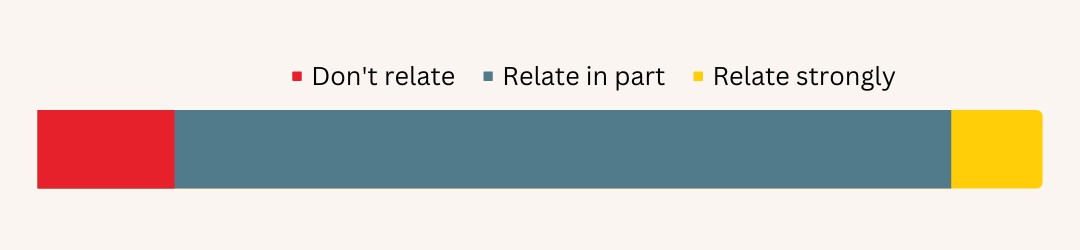

We’re hiring more people to our R&D team and want to make sure they’re properly trained.

I sometimes worry that our R&D claims might not be completely compliant.

We’re currently spending a lot of our time handling R&D enquiries.

Some of these results surprised us!

We expected more people to say they were spending a lot of their time handling R&D enquiries. Given the general tone of news and conversation across the industry, it has felt, at times, like enquiries were all anyone really wanted to talk about!

We were also pleased to see the number of companies who are focussed on winning new clients, and the smaller but still meaningful number who are expanding their R&D team. This shows that many R&D advisors can see there’s still life, still potential, and still room to grow in the R&D industry. We’re as committed as to them as they are to serving their clients – we’re here for the long haul too.

In contrast, we aren’t at all surprised to see that the majority of our members are keen to see industry standards improve, and to improve their own level of compliance and the quality of their service. This is the core principle of The R&D Community – raising standards through self-regulation – so we are delighted, but not surprised, that the vast majority of our members prioritise this too.

What other challenges are R&D advisors facing?

We also gave members the chance to tell us about their priorities and challenges in their own words. There were a few common themes in what they told us:

Misinformation/ misunderstanding

Several members felt that a key challenge for the industry is how much misinformation is out there. Clients often have the wrong idea about what qualifies for R&D tax relief. Plus the guidance is difficult to interpret, and even HMRC seems to have adopted an approach that conflicts with its own policies and stated values.

- “There’s a gap between what the client perceives the relief to be and what the legislation allows. I feel this is perpetuated by the government announcements showcasing the benefits, vs the reality of making a claim and risk of getting an enquiry.”

- “Understanding HMRC’s definition of what an advance is – it is quite vague. Having a better relationship with HMRC to improve the industry as a whole.”

- “Disconnect between government policy and HMRC’s policing of the scheme.”

For many, improving their own knowledge of the scheme can help to tackle all these challenges. When you’re confident in what you know, it’s easier to demonstrate to clients and HMRC that you’ve accurately drawn the boundaries between what qualifies for R&D tax relief, and what does not.

Dissatisfaction

With all the changes in the guidance, the rates of relief, and even HMRC’s approach to enquiries, there were several comments from advisors who are feeling the pressure.

- “I do not have much faith in the R&D tax regime.”

- “Thinking of retiring as it’s all getting very stressful!”

- “Continual erosion of the SME scheme.”

It’s common, in times of turmoil, for those affected to feel demoralised and to seek out communities of support. We foster this type of peer network through our Members’ Forum and our live webinars, as we encourage our members to ask each other questions and share their experiences.

Competition

A major concern for some firms has been in their sales and marketing, and the visibility of their service. R&D tax relief is a crowded market, as I’m sure you’ll know, so firms have to work hard to win every single client.

- “Whilst HMRC are taking steps to deal with rogue advisors they are still a major issue when it comes to bidding for work. Until they are stopped it’s becoming increasingly difficult to compete.”

- “Differentiating ourselves against adverse publicity from other firms saying that only they have the expertise to do R&D Tax Credit Claims.”

- “Demonstrating that we are regulated, and that we are experts in our field.”

We do as much as we can to support our members and raise their profile. We host a Members Directory, where SMEs can find an advisor to work with based on their training record with us. We refer work to our members, when it comes our way, and encourage them to pass leads to each other through the forum. We have also begun to provide guidance and resources on marketing and promoting themselves, using their membership of The R&D Community as a selling point.

Our plans for the next year or so include developing the industry’s first qualification in R&D tax relief, and we expect this to be a valuable credential for providers who want to demonstrate good practice, exacting standards and responsible advice.

Changes to the R&D scheme are affecting how advisors charge for their services

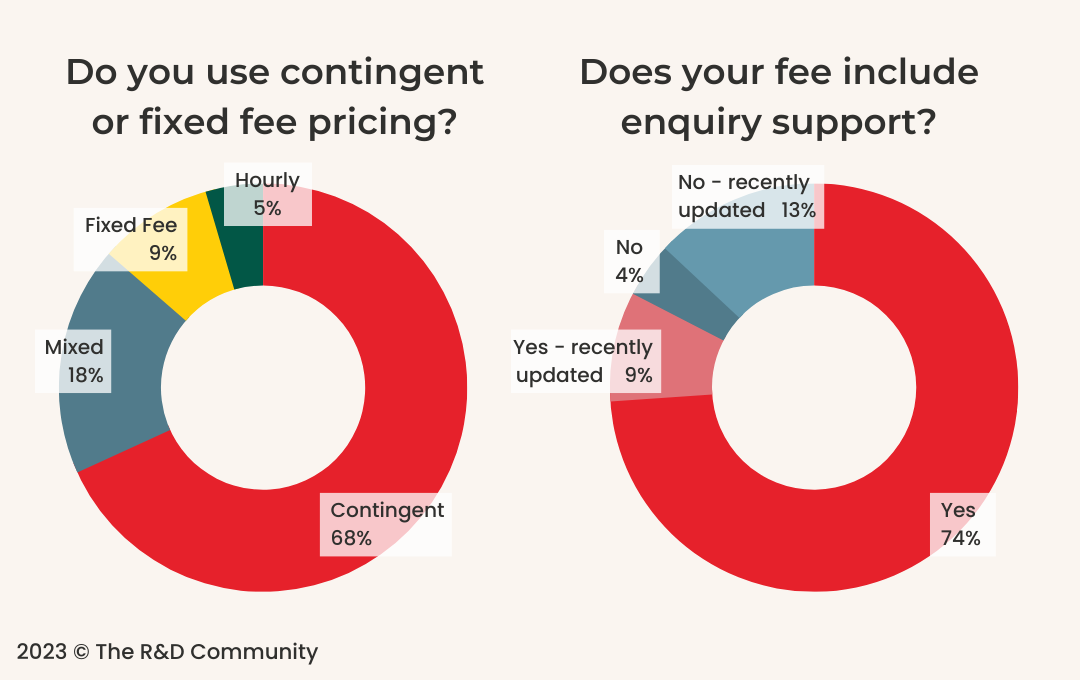

Given HMRC’s robust approach to enquiries and the reduced rates of relief, we knew going into the survey that one of the major concerns for R&D advisors right now is how to adapt their fees to keep their businesses sustainable.

Here’s how they charge and whether they include enquiry defence in their fee.

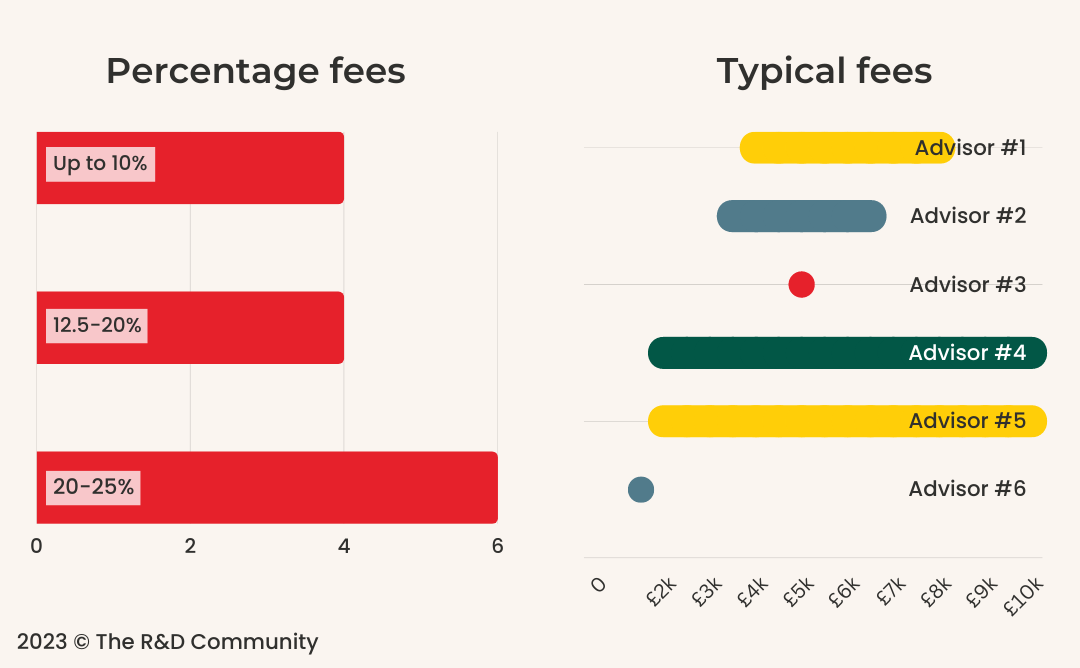

The majority of our clients charge a contingent fee and include enquiries in that fee. This has always been a popular model for consultants, but it’s popular with accountants too. We also asked them about the rates they actually charge. Most members gave the percentage, but six gave us a typical figure, or range, as you can see below.

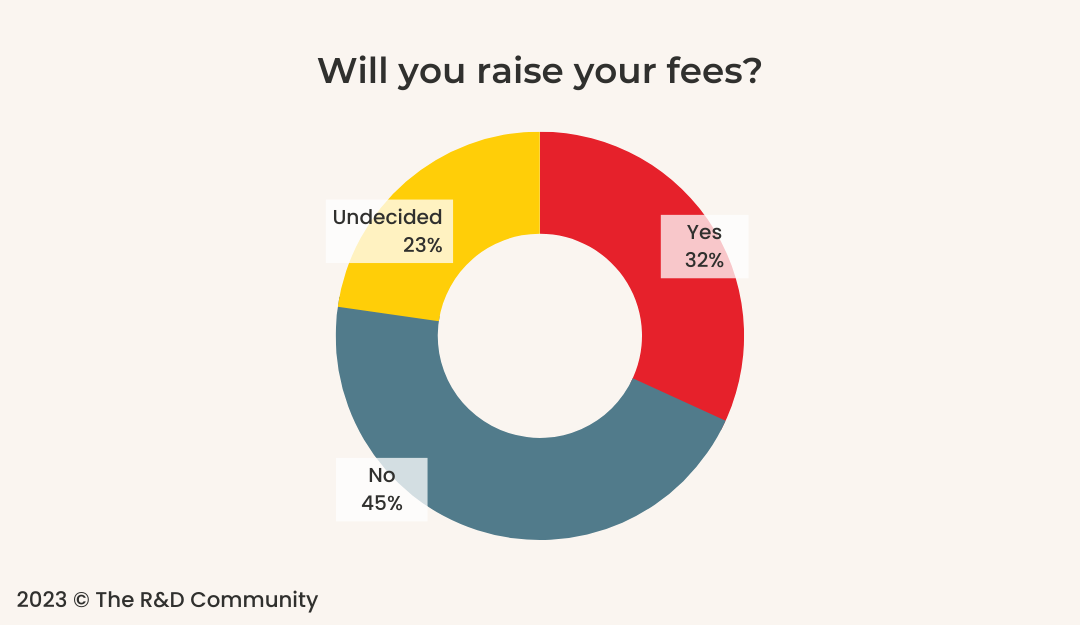

When we asked about changes, the results were mixed – some had already made definitive decisions, others were still on the fence.

For those as yet undecided, it seemed that many were considering a different approach, rather than simply increasing the percentage fee. One member mentioned an ‘R&D lite’ approach for lower value claims.

Another went into detail about a similar idea, designed to support small but innovative companies. Thus far, they have been preparing claims even at a loss, to support these clients. However the current climate makes this unsustainable.

- “We are exploring how we can create a ‘how to pack’ for general submissions, where the client is a SME and likely to receive a benefit under £20k.”

For those who have decided to increase their fees, there seem to be two clear driving factors – more work is required to ensure the compliance of each claim, and contingent-based fees are dropping in value as the rate of R&D relief has reduced.

- “The scurrilous R&D agents who have been responsible for the fraud have run for the hills, leaving their often, but not always, innocent clients with nowhere to turn. At the same time, legitimate operators are the only ones faced with answering HMRC’s onerous letters on behalf of their clients.”

- “Impacted the service we offer accountants as smaller claims will require minimum fees and will probably be unviable commercially now. Increased opportunity to support claimants under enquiry that are not claims we have prepared.”

With the additional risks of enquiry in 2023, one member explained that they’ve increased fees to cover “more work and backup involved for claims” and because they want the extra peace of mind of using our Claim Review service to support them.

If you’re changing your rates or your fee structure in response to the current upheaval, we’d be interested to hear your story – what changes you’re making and why. You can always get in touch with your thoughts and questions.

What do members think of The R&D Community?

The last set of questions in the survey focussed on members’ thoughts on The R&D Community itself. These might be of interest if you’re considering joining us yourself!

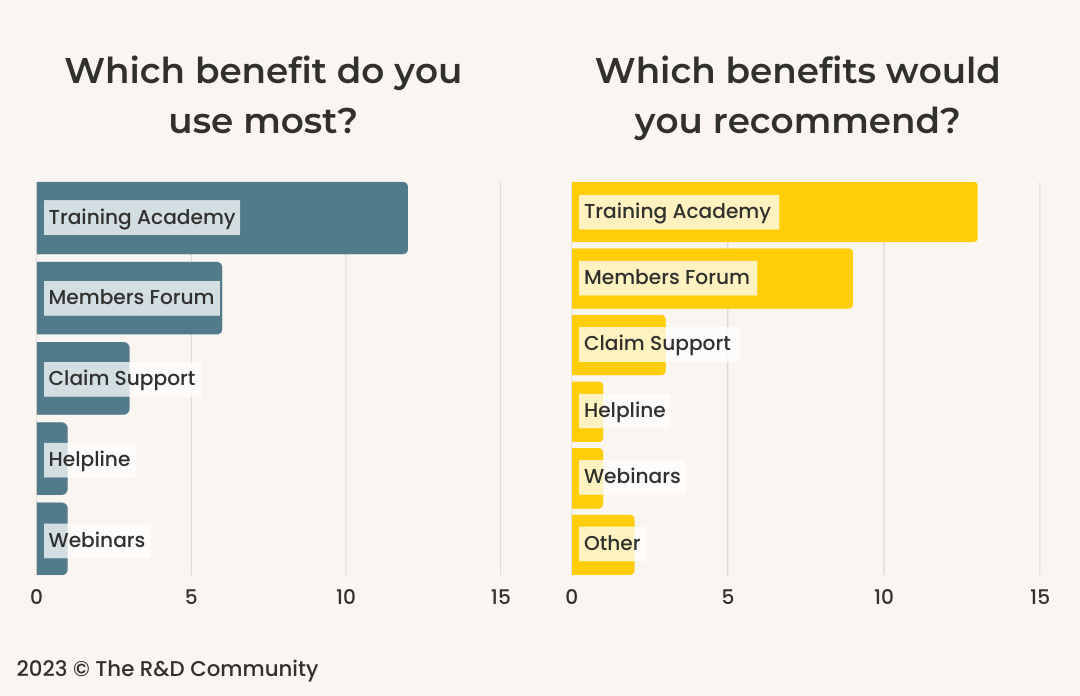

First we asked our members which of our benefits is the one they make the most use of. We also wanted to know which services they’d recommend to a someone who was interested to join.

Our Training Academy is by far the most popular aspect of membership, which is great to see!

As well as it being the most used feature, it’s also the one members are most likely to recommend to others. The academy includes all our training courses, as well as the recordings of all our live webinars.

Also very popular is our members forum – which runs as a private WhatsApp group. Members find the forum useful as it helps them get different perspectives on responses from HMRC, find out news of what others are experiencing, and ask questions about unique or tricky cases. Several members commented that the group as a whole was very open and willing to share experiences, which is part of what makes it so valuable.

How membership of The R&D Community can help you achieve your goals

We also asked our members what their goals were in joining the Community, and how membership has helped them achieve, or work towards those goals so far. We’ve included a selection of these comments below.

| What’s your goal? | How has membership helped? |

| Ensuring compliance and training our team | Claim support service was invaluable in defending a claim. We’re now going to fully utilise the training service. |

| Gaining new knowledge to hopefully attract new clients | It’s been useful to use the training in live cases and also ask for support where required |

| To “outsource” technical queries from my employee so I could concentrate on building the business. | It has saved me time and stress, |

| Specific Training | I feel comfortable that my team are up to date and trained properly |

| Not working in a silo and having peer support | Access to trusted R&D specialists and trusted members |

| To handle increased HMRC scrutiny of claims and to differentiate from competition as a quality provider. | It has added to our service and helps sustain our reputation. |

| Find training that isn’t available elsewhere; also it’s beneficial when showing customers that we are a reputable and reliable company for R&D | Got some formal training! Also can prove to customers who are looking at cheaper options why they should choose us. |

| Keep up to date on industry shift | Understanding and reviewing how others are dealing with changes |

| Cope with HMRC’s new level of scrutiny with enquiries. Also, ensuring we are compliant in everything we submit. | Learning how to meet the standards HMRC expect. |

| Training staff who are new to the industry, without giving them bad habits or older understandings of the scheme. | Our team has grown in knowledge and probably enjoyed hearing someone else’s voice! |

| Training new staff and having a consistent approach | It’s been refreshing for me to have some relevant CPD and now I have a team that are able to listen to someone else and not just me. |

| Get ahead of rise in enquiries and find clear guidance. | It’s still early but I am becoming more reassured that the majority of what I have been doing is to a good standard. |

| Training for new team members as we scale. Also make sure we are aware and kept up to date of any legislation changes. | Training saves time of other team members |

| I needed to ensure our claims would stand up to enquiries | HMRC aside, they should now stand up to enquiry |

Lastly, we asked for ‘any other comments,’ and many members were kind enough to share lovely feedback!

- “Love what you’re doing. So much. And really pleased to see you all make such strong progress in your mission 👍”

- “Just to say I have found membership very useful and have got support from other members on some complex claims I am doing.”

- “Keep up the great work!”

- “It’s been worthwhile. Richard is very committed to the R&D cause and does seem to care about everyone.”

- “Fantastic at a time when it was needed.”

- “I thought membership was expensive to start with and only the lack of notice period convinced me to join. But the value is increasing all the time as the resources, team and community grow so it now represents very good value for money.”

- “I’m pleased I joined.”

- “It’s fantastic, if there is anything I can ever do to help, please let me know.”

- “It’s been very beneficial and I look forward to seeing what is to come.”

Interested in membership?

If you’re interested in joining The R&D Community, you can find out more about all the membership benefits and pricing before you get signed up.

If you’re still looking for more information, you mind find these resources and case studies helpful.