This is one of the reasons why R&D tax relief is now a crowded market. A lot of people – accountants, business consultants, industry experts and others – are setting up new services to support businesses making claims. There’s now a lot of competition for clients and for staff, yet very little guidance on how to run a successful and ethical R&D service.

In this guide, we want to give you all the key information you need to get started preparing claims. We’ll cover the key steps of the claims process, and sprinkle in some insider insights, to help you get ahead of the learning curve. R&D tax relief has historically been a secretive, insiders’ club, where the only way to learn was on the job. We’re keen to change that with resources like this guide, and our training, so that you can be confident and successful in running your own R&D service.

Contents

- Step 1 – Check the client meets the scheme’s basic requirements

- Step 2 – Agree terms with the client

- Step 3 – Discuss how their project is eligible

- Step 4 – Gather relevant costs and work out the value of the claim

- Step 5 – Write the report about the project

- Step 6 – Submit the claim

- Step 7 – If needed, handle an HMRC enquiry

- Where to find more support and training

Step 1 – Check the client meets the scheme’s basic requirements

The very first thing to do when considering preparing a claim for a client is to check they meet the basic criteria for the R&D tax relief scheme.

Who qualifies for R&D tax relief

The scheme is designed to encourage businesses to invest in research and development (R&D) by offering tax relief on the cost of the R&D.

The relief can either reduce the company’s overall tax bill, result in a refund of Corporation Tax, or in some cases, provide a payable tax credit.

There are certain basic facts that immediately mean a company can’t claim for R&D tax relief. It’s not worth discussing R&D at all if:

- The organisation is an LLP

- The company is in administration or liquidation

- Their last set of accounts state that the company isn’t a going concern

- They don’t have any expenditure

If they’ve approached you asking to make a claim, and they don’t qualify, you’ll need to explain why not. If you’re considering approaching them to pitch your services, make sure you do your research first!

For more guidance on how to have this conversation, you can read our article How to Talk to a Client about Whether an R&D Claim is Right for Them.

Another thing to consider, before investing a lot of time with the client, is the industry they work in. Businesses in some sectors are more likely than others to be doing qualifying R&D work. The most common are manufacturing, software development, food and drink, and engineering. If a client approaches you who’s not in one of these sectors, it’s a wise idea to get a clearer idea of the project they’re hoping to claim for before you agree terms.

A warning about claims from low R&D sectors

Businesses in low-intensity R&D sectors CAN still be conducting R&D. HMRC’s guidance on what qualifies is intentionally broad and subjective, which means that lots of different types of company can potentially make a claim.

However, sometimes sketchy R&D firms take advantage of this to make a quick buck. They convince businesses that their day-to-day operations count as R&D, so that they’ll make a claim. A more ethical advisor would advise the client otherwise!

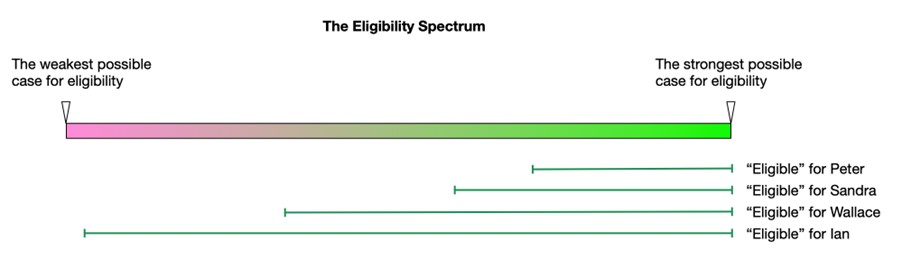

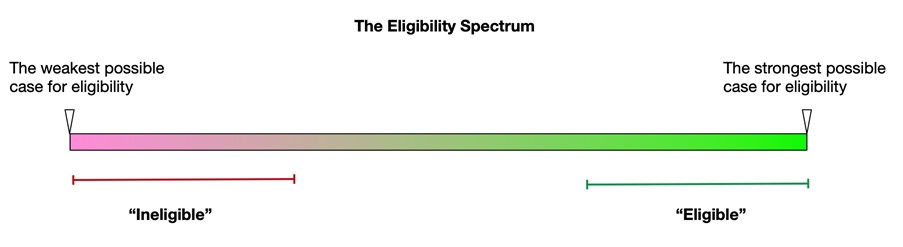

As a new advisor, we want you to know that there’s a big grey area between work which is Definitely Eligible, and work which is Definitely Ineligible. The terms “eligible” and “ineligible” can be quite elastic – and some advisors manage to stretch “eligible” as far as they possibly can.

When you first start preparing claims, it’s wise to look for work that is more clearly eligible. A key part of your role as an advisor is to collect evidence supporting WHY a project is eligible, and we’ll talk about that more in Steps 3 and 5.

Inevitably, you’ll find yourself declining to work with certain companies. It can be frustrating to tell a prospect that they’re likely not eligible, only for them to claim through a different provider with lower standards. We’re pleased to see HMRC’s changes over the last year or two are beginning to help to counteract this, together with measures it has taken to tackle error and fraud associated with R&D claims. We are also ourselves working towards self-regulation, and a shared understanding of the R&D scheme and how to apply its rules fairly and consistently, embodied in our certification programme.

Step 1 recap

Your first task is to make sure that your client meets the basic qualifications for R&D tax relief. At the same time, it’s good to get an idea of the work they’re doing, and how likely it is to be eligible, before you start.

There’s a lot that goes into building a sound process for generating, screening, and qualifying leads for R&D tax relief. We have some free resources that can help, like our screening template, but if you’re looking for more in-depth guidance you should check out our training course: Qualifying Leads for R&D Tax Relief.

Step 2 – Agree terms with the client

Once you’re reasonably sure there’s a claim to be made, it’s time to agree terms with the client. There’s a lot involved in making an R&D claim on behalf of a client, so you need to be clear on the expectations and responsibilities on both sides.

Set out the deliverables, and the timeline, of the claim, so they understand what to expect, and what they’ll need to provide you. If you want more guidance on how to structure your service and designing your claims process, take a look at the following free resources:

[Guide] How to run an in-house R&D service

[Article] Becoming an R&D tax advisor: Realities and responsibilities

This should also be when you discuss and agree on a fee. You may decide to set a fixed fee for the claim, or you can charge a contingent fee.

We’ve covered the topic of setting fees for your service in detail in our blog How to charge for your R&D service. It has examples of different fee structures, along with all the pros and cons you should consider.

Step 3 – Discuss how their project is eligible

Once you have agreed terms with the client, your next step will be to gather detailed information from them about the project, and how it fits into HMRC’s guidance.

HMRC’s definition of R&D for tax purposes is very abstract. It’s designed to apply in any sector, which means you need to translate it into more specific terms for your clients. The key parts are that the company:

- must be ‘trying to make a technological advance’ and

- must try to overcome ‘technological uncertainties’ in the process.

Your job is to help clients understand how HMRC’s definition of R&D applies to them. Of course you need to show them the guidance itself – but you also need to gather the details you need to write a report about the project and how it fits the two criteria. HMRC’s further Guidance for Compliance 3 (GfC3) provides some useful examples explaining the meaning and application of the key points the client will need to consider.

This process of teasing out relevant information from the client is the foundation of any successful R&D claim, so we’ve gone into detail about how to get it right in our article 3 Steps to Effective R&D Eligibility Screening Conversations. We also have a free downloadable checklist to help you keep track of everything you need.

‘Eligibility’ for R&D tax relief isn’t binary

When you hear R&D providers talk about projects, they’ll often make statements about work being ‘eligible’ or ‘ineligible’. They’ll talk about eligibility like it’s black and white, yes or no, qualifying or not qualifying.

But as we mentioned earlier, there’s a big grey area, created by HMRC’s subjective definition, and that makes things a bit more complicated.

With your assistance, your client needs to be able to judge:

- whether an advance has been made relative to other existing technologies,

- whether that advance is genuine and non-trivial in the eyes of someone with relevant industry experience, and

- whether the problems and challenges involved were difficult enough to meet HMRC’s definition of ‘technological uncertainty.’

Each of these judgements is nuanced and subjective, not black and white. R&D projects lie on an eligibility spectrum that runs all the way from ‘We can’t see how this could possibly qualify’ to ‘There’s a really, really strong case why this qualifies’ – and this is where the assessment of the competent professional is crucial to the integrity of the claim.

So when an advisor says that a particular project is ‘eligible’, what they’re really saying is ‘In our opinion, and based on the evidence that has been provided, this work is a match for HMRC’s definition of R&D, so we’d be happy to help you claim for it’.

Your primary task as an advisor is not to become an expert in all areas of technology (which would be impossible in any case). Instead, you have to get really good at explaining the eligibility criteria to your client, so that THEIR technical experts can see whether or not there’s a good case to be made.

As well as the article and free checklist referenced earlier, we also offer a course called Explaining Eligibility, which covers the subject in a lot of detail.

Step 3 recap

Explain HMRC’s guidance to your client and get their expert view on how their project qualifies. Gather the information you’ll need about the advance they worked towards, and the challenges they overcame, which you’ll need to prepare the claim.

Step 4 – Gather relevant costs and work out value of the claim

After you and the client have talked through their work, and agreed exactly which parts of which projects will be included within the claim, your next step is to gather from the client all the information about the qualifying expenditure on the project.

What costs qualify for R&D tax relief

The major expense is usually staff costs – including salary, national insurance, and employer’s pension contributions. You should work out the total cost of the staff member, and then work out what percentage of their time was spent on R&D.

At the most, we’d recommend you claim for 95% of staff costs – even for employees who ONLY work on qualifying R&D projects. This leaves room for time spent on things like annual reviews, company-wide meetings, safety training etc, which aren’t R&D-related.

There are a few things in the costs section of your report that might raise a red flag with HMRC. 100% staff apportionments can be one of them! In some cases those apportionments can be defensible, but you’ll need to make the case for it in your initial claim. Reducing your apportionment will have a nominal effect on the overall claim value, but with a huge benefit in reducing the risk of that enquiry.

For a full list of the red flags you should avoid in your claims, download our free Red Flag Checklist.

As well as staff, there are some other costs you can claim for. These also come with caveats. If you’re claiming for subcontractor costs, make sure you’re clear that your client was directing the R&D project, not the subcontractor.

The rules for subcontracted R&D vary quite a lot between schemes – take our free course on the Merged R&D Scheme to learn about the differences and how they’ll affect your client. If you’re claiming for consumable materials, these must be used up or destroyed in the R&D process, and not be turned into saleable materials or products. Likewise, the costs of prototypes can be included as well, but not if the prototype was built with the intention of selling it.

Step 4 Recap

Gather the details of all the qualifying costs in your client’s projects. Check which scheme your client can claim under, and make sure you stick to the rules of the scheme to determine exactly which costs to include in the claim.

Step 5 – Write the report about the project

Writing the report on the R&D claim goes alongside gathering the costs. With your notes from the meetings about eligibility, and any materials sent over by the clients, you can write up a report which describes the projects and how parts of them qualify for tax relief.

The key things to include are

- the baseline level of technology

- the advance made, or attempted

- the technological uncertainty they tried to overcome

- why the solution wasn’t readily deducible the technical experts working in the team.

You can also include things like patents, or IP contracts, if those contribute to the overall picture of the projects. Many of these terms are explained in depth in our course on ‘Explaining Eligibility’, which you can access once you become a member.

Before you submit your report alongside the CT600, you’ll need to submit an Additional Information Form (AIF) – we recommend you streamline your process so that you’re able to include the same text in both. While technically the report isn’t essential, many advisors still create one for the client to review and approve. This also ensures that you’ve collected all the details needed to prepare a defensible claim.

Earlier we mentioned above some red flags relating to the costs involved in the claim. There are also some key phrases to avoid in your report and AIF, as they can flag up concerns at HMRC.

A big one refers to describing the outcome of a project as ‘bespoke’ or ‘unique’. Using these words can prompt HMRC to ask whether a project involves an advance in technology – as opposed to just being a custom piece of work. This is especially true of software projects, where eligibility is frequently misunderstood. So, instead of focusing on whether something is new and different, you want to clarify how it’s new and better – in a technological sense rather than commercially.

For all the potential red flags to avoid, download our Red Flag Checklist.

Using software to prepare R&D claims

A lot of accountants use R&D claim software to help them structure the process, gather costs and write their reports. There are plenty available on the market, and we think they’re a great investment if you’re new to preparing claims, or short on time.

Most R&D consultants have their own processes established in the firm, or from previous roles, although some do find R&D software helpful as a way to make their service more consistent.

We especially recommend combining any use of R&D software with high quality training – so that you know you’re doing all the right things the right way.

More info: Why you should invest in R&D training AND software

Step 6 – Estimating the tax benefit of the claim

Once you and your client have identified how much of their expenditure qualifies for relief, your next task is to estimate the type and size of the tax benefit.

Before we walk you through some examples, let’s look at the basics of how the relief works. (If you’re an accountant and already familiar with this, you may wish to skip ahead to Step 7.)

How does R&D tax relief work?

R&D tax relief works in different ways depending on the scheme through which you are applying. For the SME, R&D Intensive and ERIS Schemes, it allows companies to adjust their profit downwards so that they pay less corporation tax. A loss-making company can surrender some or all of that loss, depending on the circumstances, in exchange for cash from HMRC.

This works out well in the long term for HMRC. When a company surrenders their loss for the payable credit, they can’t use that loss to offset future profits. That means they start paying Corporation Tax sooner.

Under the old and new RDEC Schemes, the RDEC credit actually increases trading profits, but is then subtracted from the company’s overall tax liability.

The rate of the relief will vary depending on the scheme which the company is claiming under – and there are various rules which determine which one applies to your client.

Related: Advisors need to grapple with 4 different R&D schemes come 1 April 2024

How is an SME’s profit adjusted?

If your client is an SME, and their qualifying expenditure was incurred before 1 April 2023, this is how to calculate their tax benefit.

The SME R&D tax relief scheme allows companies to enhance their R&D expenditure by an additional 130% (known as the ‘enhanced deduction’). This means that for each £1 that an SME spends on R&D, it can reduce its profit by an additional £1.30. It deducts a total of £2.30 from its profit, which is why you’ll often see people referring to the rate of R&D tax relief as 230%.

If the expenditure was incurred on or after 1 April 2023 for an accounting period that begins before 1 April 24, the enhanced deduction was reduced to 86%.

What tax benefits can result from a claim for R&D tax relief?

As we’ll see in our examples shortly, SMEs can get a few different types of tax benefit when making a claim for R&D tax relief. These are:

- A deduction in the Corporation Tax due to HMRC

- A rebate of Corporation Tax that was paid in previous claim periods

- A deduction that can be used against profits made in future claim periods, and

- A ‘cash credit’ from HMRC in exchange for ‘surrendering’ their losses

The type of tax benefit arising from an R&D claim depends on:

- The company’s pre-tax Profit/Loss position

- How much they’ve spent on R&D

- How their accountant decides to use the relief (usually taking the client’s preferences into account)

Can you give me some examples?

Sure thing! The three examples we’ll look at are:

- An SME making lots of profit

- An SME making a loss, and

- An SME near breakeven

In all three examples, let’s assume that our SME has spent £50k on qualifying R&D, before 1 April 2023, so is allowed an enhanced deduction of £50k x 130% = £65k.

Example 1

In this example, our SME has made a handsome profit of £450k in the claim period.

| SME’s pre-tax P/L | £450k |

| Enhanced deduction | £65k |

| SME’s pre-tax P/L after enhanced deduction for R&D | £385k |

This means that the company no longer has to pay Corporation Tax (@ 19%) on £65k of its profits. That saves it 19% x £65k = £12,350. Nice!

Example 2

This time, our SME has made a loss of £150k in the claim period.

| SME’s pre-tax P/L | [ £150k ] |

| Enhanced deduction | £65k |

| SME’s pre-tax P/L after enhanced deduction for R&D | [ £215k ] |

For claims before 1 April 2023, the tax credit rate was 14.5%, and for claims between 1 April 2023 and 31 March 2024, the rate was reduced to 10%.

The way the payable cash credit is calculated is 14.5% of the lesser of:

- The company’s trading loss, which in this case is £215k, and

- 230% of the company’s expenditure on R&D, which in this case is £115k.

The lesser of these two figures is £115k. This means that the SME can surrender £115k of its loss in exchange for a cash credit of 14.5% x £115k = £16,675. Afterwards, it still has £100k of losses to carry forward.

Example 3

In our last example, the SME is close to breakeven with a pre-tax P/L of £10k. This calculation is slightly more complex, as this time the company will get two different types of benefit: a deduction in Corporation Tax and a cash credit.

| SME’s pre-tax P/L | £10k |

| Enhanced deduction | £65k |

| SME’s pre-tax P/L after enhanced deduction for R&D | [ £55k ] |

As before, the adjustment has resulted in a loss. Again, we calculate the cash credit as 14.5% of the lesser of:

- The company’s trading loss, which in this case is £55k, and

- 230% of the company’s expenditure on R&D, which in this case is £115k.

The lesser of these two figures is £55k. This means that the SME can surrender its entire £55k loss in exchange for a cash credit of 14.5% x £55k = £7,975.

However, notice that the company was due to pay Corporation Tax on its £10k profit. It no longer has to do so, saving it a further 19% x £10k = £1,900.

Is it always this straightforward?

Sadly, no. While it’s usually straightforward to give an SME an estimate of their claim size and type, its calculation can be complicated by accountancy factors like group relief, carried forward losses, and other forms of relief. That’s why we’d generally recommend leaving the tax computation (and submission of the claim) to the client’s accountant, who will be privy to the client’s full financial situation.

For a detailed explanation of the tax computation, take a look at HMRC’s guidance – CIRD90500.

Please note that these calculations only cover the SME scheme, although those for the R&D Intensive and ERIS schemes are similar. The values of claims made under the old and new (merged) RDEC schemes are calculated differently. You can find an explanation of that in CIRD 89780.

Step 7 – If needed, handle an HMRC enquiry

Usually, submitting the claim is the last step. Your client will receive their tax benefit and you’ll hear no more about it. Sometimes, however, your claim will generate an enquiry from HMRC. The first you’ll hear of this will be a letter to the client from HMRC, asking for more information about the claim.

How does HMRC select R&D claims for an enquiry

You won’t find much written down about how HMRC selects claims for enquiry. We do know that they regularly conduct random enquiry programmes, meaning a percentage of all claims are queried even if there are no red flags in the submission.

In other cases, the pattern we see is that HMRC has two distinct levels of scrutiny when assessing R&D claims.

Most claims, pass the first level of scrutiny, where HMRC are looking for a certain pattern of risk factors.

For example, they might be focused on claims of a certain size and in a specific sector. If your claims match the pattern they’re looking for, they’ve got a higher chance of being selected for enquiry.

Reviewers also select claims for enquiry when they contain one or more ‘red flags’. These are aspects of the claim that are both obvious and concerning, such as Directors’ time being claimed at, or close to, 100%.

Related: R&D Red Flag Checklist

If your claim is selected for enquiry, you can then expect it to be subjected to a much higher level of scrutiny.

Responding to an enquiry can be straightforward if you’ve laid the groundwork well in your initial claim. Well prepared claims pass the higher level of scrutiny more easily. If your initial claim was weak, you’ll have to work harder to get it through this stage.

Either way, you’ll need to provide more detail and information to HMRC and there are a wide range of consequences depending on your level of success.

Related: An Insider’s Guide to R&D Tax Relief Enquiries

Enquiries can be good for you

Sometimes you’ll hear R&D advisors proudly stating that they’ve never had an enquiry. Because enquiries are a natural part of the claims process, it’s normal for all advisors get one eventually. So “we’ve never had an enquiry” is not a great brag, as it also means “we haven’t prepared many claims.” So use the phrase with caution in your own marketing!

Secondly, if the enquiry is led by a named caseworker at HMRC, this can be an excellent way to learn more about how HMRC applies its definition of R&D to real-life projects. These enquiries are generally more nuanced and productive, with HMRC less reliant on templated responses. They will be more focused on particular evidence that has been presented to support the claim. While they might seem gruelling and frustrating, they can leave you with much stronger knowledge about the scheme and how the rules should be applied.

So don’t be afraid to say that yes, you’ve had enquiries. After all, experienced and knowledgeable advisors have been through multiple R&D enquiries and learnt a lot in the process. Wise clients know that an enquiry is a risk, so they’ll be looking for an advisor with the experience to handle one correctly.

Where to find more support and training

The R&D Community was founded to help people develop their skills, knowledge and confidence in R&D consultancy. With our training and support, you can build your own confidence and expertise in a matter of months, instead of through years of trial and error.

And in fact, we think you’ll get to a better place than you would by working alone. After all, our Community allows you to benefit from the experience of all our members, so you never feel alone or isolated when dealing with HMRC or awkward clients or questions.

To discover everything that membership includes and all the ways we could help, watch our free product demo. You’ll get a sneak peek of our training platform, and get to meet our expert support team.

Contents

- Step 1 – Check the client meets the scheme’s basic requirements

- Step 2 – Agree terms with the client

- Step 3 – Discuss how their project is eligible

- Step 4 – Gather relevant costs and work out the value of the claim

- Step 5 – Write the report about the project

- Step 6 – Submit the claim

- Step 7 – If needed, handle an HMRC enquiry

- Where to find more support and training