More and more accountants see the benefit of supporting their clients with R&D tax relief advice. If they are new to this work, they may look for help from an R&D adviser.

How to encourage collaboration between R&D consultants and accountants

Start as you mean to go on and help the client and their accountant see how you intend to work. When you take on a new client, ask them to introduce you to their accountant via an email or if possible, have a face to face or video meeting.

You want to show them you work professionally and transparently and you have nothing to hide. This is also an opportunity to share your credentials and industry experience and demonstrate that the client is in safe hands.

Encourage both your client and their accountant to ask questions about how you work and how you establish the client is eligible to claim the tax relief. The accountant’s input can be especially helpful, when it comes to reviewing your technical narratives before they’re submitted. If your report doesn’t lay out the key information in layman terms, it’s at risk of an enquiry. The accountant’s feedback can give you a chance to revisit your work before it’s submitted to HMRC.

Establishing eligibility with support from the client and their accountant

The accountant will be looking to you as the R&D tax relief expert to make their life as easy as possible.

Establishing eligibility is challenging, but essential. It depends heavily on the questions you ask, the client’s answers and your follow up questions.

Your job is to establish the client’s eligibility by educating them about HMRC’s guidance and the underlying legislation. The output of this process will be a concise technical report, which sets out how your client qualifies for the tax relief and the eligible costs being claimed.

You may choose to invite the accountant to sit in on the initial scoping meeting with the client. This can provide the accountant with reassurance that you know what you are talking about. The client might also prefer to have their accountant present so they can field any questions about payroll, costs, and corporation tax.

What information does an accountant need to submit an R&D claim?

When you have finished the tax relief claim and agreed it with the client, your next job is to email it to the accountant. If you send it as a pdf attachment, it is easy for the accountant to attach it to the CT600.

Put a breakdown of the enhanced expenditure figures in the body of the email, together with the impact on the corporation tax position. If your client is loss making and you are able to do so, you can also set out the various loss treatments available. Don’t worry too much about this latter point – it can be helpful, but it is not imperative you know this.

You may also need to remind them that the client’s bank details should be included on the CT600 to make the payment of any tax refunds or credits as fast as possible.

The key is to share all the relevant R&D tax relief information with the client’s accountant and answer any questions they might have. In return, you can ask for sight and confirmation of the final submission to HMRC including confirmation the technical report was submitted as part of it.

What issues might arise when your client’s accountant submits the R&D claim for you?

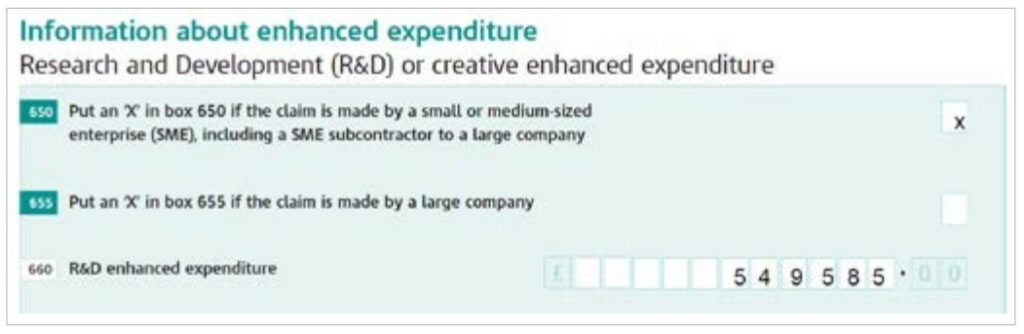

A common mistake made with SMEs claims, which is not always picked up by the accountant, is the completion of box 660. It should record the “total R&D tax relief enhanced expenditure.” Here’s an example from HMRC’s own guide to completing R&D claims. As you can see, the figure entered in the box 660 must be calculated appropriately based on the allowable costs.

It’s also worth noting that the enhanced deduction of 130%, as shown here, is reducing to 86% for all expenditure incurred on or after 1 April 2023.

| Total allowable costs | £238,950 |

| Multiply by 130% | £310,635 |

| Add these together to get the total R&D tax relief: ‘enhanced expenditure’ | £549,585 |

Some accountants may not have worked on R&D tax relief claims before, so it’s helpful to clarify the calculation and correct figure to enter in your email.

Accountants and R&D Consultants CAN work successfully together!

As you can see, there are a few ways to make sure you have a positive working relationship with your client’s accountant, which can help your produce a more effective claim for your client. Make sure you:

- Introduce yourself to the client’s accountant and encourage their participation,

- Invite the accountant to join you for key conversations around eligibility and costs,

- Provide a PDF copy of the report with key figures and calculations highlighted in the email.

- Ask the accountant to show you the confirmation that they have submitted the claim and attached your report.

If you’re looking for more advice on preparing claims, or resources for your client’s accountant to help educate them, try our Beginner’s Guide to Claiming R&D Tax Relief.